Form Au-330 - Controlling Interest Transfer Taxes

ADVERTISEMENT

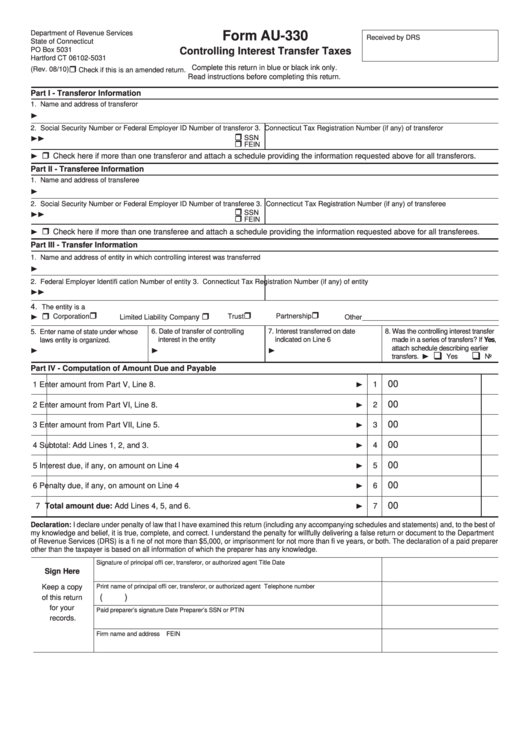

Department of Revenue Services

Form AU-330

Received by DRS

State of Connecticut

PO Box 5031

Controlling Interest Transfer Taxes

Hartford CT 06102-5031

Complete this return in blue or black ink only.

(Rev. 08/10)

Check if this is an amended return.

Read instructions before completing this return.

Part I - Transferor Information

1. Name and address of transferor

2. Social Security Number or Federal Employer ID Number of transferor

3. Connecticut Tax Registration Number (if any) of transferor

SSN

FEIN

Check here if more than one transferor and attach a schedule providing the information requested above for all transferors.

Part II - Transferee Information

1. Name and address of transferee

2. Social Security Number or Federal Employer ID Number of transferee

3. Connecticut Tax Registration Number (if any) of transferee

SSN

FEIN

Check here if more than one transferee and attach a schedule providing the information requested above for all transferees.

Part III - Transfer Information

1. Name and address of entity in which controlling interest was transferred

2. Federal Employer Identifi cation Number of entity

3. Connecticut Tax Registration Number (if any) of entity

4.

The entity is a

y

Corporation

Limited Liability Compan

Trust

Partnership

Other ___________________________________

6. Date of transfer of controlling

7. Interest transferred on date

8. Was the controlling interest transfer

5. Enter name of state under whose

laws entity is organized.

interest in the entity

indicated on Line 6

made in a series of transfers? If Yes,

attach schedule describing earlier

transfers.

Yes

No

Part IV - Computation of Amount Due and Payable

00

1

Enter amount from Part V, Line 8.

1

00

2

Enter amount from Part VI, Line 8.

2

00

3

Enter amount from Part VII, Line 5.

3

00

4

Subtotal: Add Lines 1, 2, and 3.

4

00

5

Interest due, if any, on amount on Line 4

5

00

6

Penalty due, if any, on amount on Line 4

6

00

7

Total amount due: Add Lines 4, 5, and 6.

7

Declaration: I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best of

my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return or document to the Department

of Revenue Services (DRS) is a fi ne of not more than $5,000, or imprisonment for not more than fi ve years, or both. The declaration of a paid preparer

other than the taxpayer is based on all information of which the preparer has any knowledge.

Signature of principal offi cer, transferor, or authorized agent

Title

Date

Sign Here

Keep a copy

Print name of principal offi cer, transferor, or authorized agent

Telephone number

(

)

of this return

for your

Paid preparer’s signature

Date

Preparer’s SSN or PTIN

records.

Firm name and address

FEIN

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3