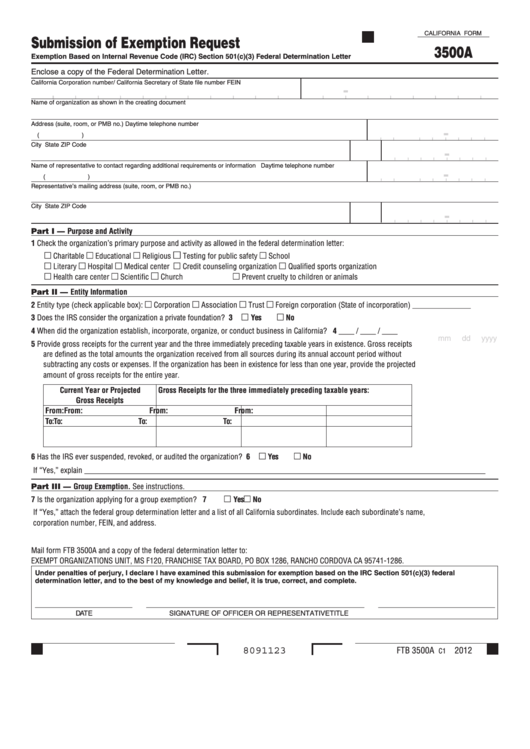

California Form 3500a - Submission Of Exemption Request

ADVERTISEMENT

CALIFORNIA FORM

Submission of Exemption Request

3500A

Exemption Based on Internal Revenue Code (IRC) Section 501(c)(3) Federal Determination Letter

Enclose a copy of the Federal Determination Letter.

California Corporation number/ California Secretary of State file number

FEIN

-

Name of organization as shown in the creating document

Address (suite, room, or PMB no.)

Daytime telephone number

-

(

)

City

State

ZIP Code

-

Name of representative to contact regarding additional requirements or information

Daytime telephone number

-

(

)

Representative’s mailing address (suite, room, or PMB no.)

City

State

ZIP Code

-

Part I — Purpose and Activity

1

Check the organization’s primary purpose and activity as allowed in the federal determination letter:

m

m

m

m

m

Charitable

Educational

Religious

Testing for public safety

School

m

m

m

m

m

Literary

Hospital

Medical center

Credit counseling organization

Qualified sports organization

m

m

m

m

Health care center

Scientific

Church

Prevent cruelty to children or animals

Part II — Entity Information

m

m

m

m

2

Entity type (check applicable box):

Corporation

Association

Trust

Foreign corporation (State of incorporation) _______________

m

m

3

Does the IRS consider the organization a private foundation? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

Yes

No

4

When did the organization establish, incorporate, organize, or conduct business in California? . . . . . . . . . . . . . . . . . . . . . . . 4

____ / ____ / ____

mm

dd

yyyy

5

Provide gross receipts for the current year and the three immediately preceding taxable years in existence . Gross receipts

are defined as the total amounts the organization received from all sources during its annual account period without

subtracting any costs or expenses . If the organization has been in existence for less than one year, provide the projected

amount of gross receipts for the entire year .

Current Year or Projected

Gross Receipts for the three immediately preceding taxable years:

Gross Receipts

From:

From:

From:

From:

To:

To:

To:

To:

m

m

6

Has the IRS ever suspended, revoked, or audited the organization? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

Yes

No

If “Yes,” explain _______________________________________________________________________________________________________

Part III — Group Exemption. See instructions .

m

m

7

Is the organization applying for a group exemption? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Yes

No

If “Yes,” attach the federal group determination letter and a list of all California subordinates . Include each subordinate’s name,

corporation number, FEIN, and address .

Mail form FTB 3500A and a copy of the federal determination letter to:

EXEMPT ORGANIZATIONS UNIT, MS F120, FRANCHISE TAX BOARD, PO BOX 1286, RANCHO CORDOVA CA 95741-1286 .

Under penalties of perjury, I declare I have examined this submission for exemption based on the IRC Section 501(c)(3) federal

determination letter, and to the best of my knowledge and belief, it is true, correct, and complete.

_________________________

________________________________________________________

______________________________

DATE

SIGNATURE OF OFFICER OR REPRESENTATIVE

TITLE

FTB 3500A

2012

8091123

C1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1