Year-End Withholding Tax Reconciliation Form - Ohio Department Of Income Tax

ADVERTISEMENT

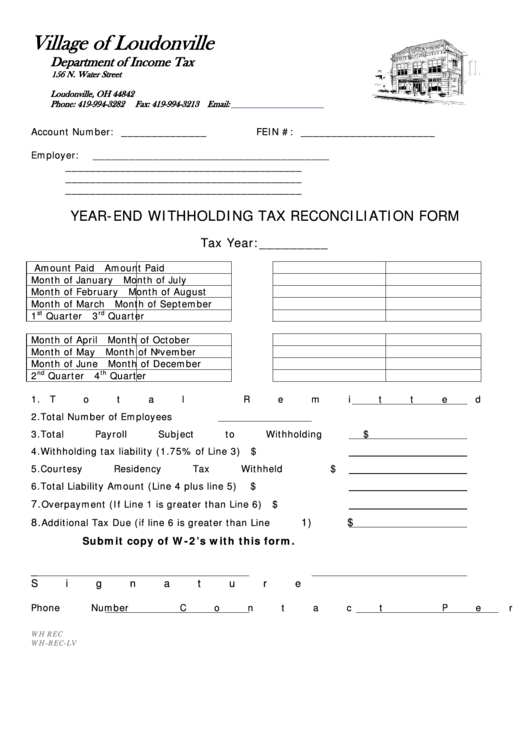

Village of Loudonville

Department of Income Tax

156 N. Water Street

P.O. Box 115

Loudonville, OH 44842

Phone: 419-994-3282

Fax: 419-994-3213 Email:

Account Number: ______________

FEIN #: ______________________

Employer:

_______________________________________

_______________________________________

_______________________________________

_______________________________________

YEAR-END WITHHOLDING TAX RECONCILIATION FORM

Tax Year:_________

Amount Paid

Amount Paid

Month of January

Month of July

Month of February

Month of August

Month of March

Month of September

st

rd

1

Quarter

3

Quarter

Month of April

Month of October

Month of May

Month of November

Month of June

Month of December

nd

th

2

Quarter

4

Quarter

1. Total Remitted for the Year

$

2. Total Number of Employees

3. Total Payroll Subject to Withholding

$

4. Withholding tax liability (1.75% of Line 3)

$

5. Courtesy Residency Tax Withheld

$

6. Total Liability Amount (Line 4 plus line 5)

$

7.

Overpayment (If Line 1 is greater than Line 6)

$

8.

1)

$

Additional Tax Due (if line 6 is greater than Line

Submit copy of W-2’s with this form.

_

Signature

Date

Phone Number

Contact Person

WH REC LV.DOC

WH-REC-LV

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1