Application For Refund From Local Services Tax Form - City Of Lock Haven

ADVERTISEMENT

L

O

C

A

L

S

E

R

V

I

C

E

S

T

A

X

–

R

E

F

U

N

D

R

E

Q

U

E

S

T

L

O

C

A

L

S

E

R

V

I

C

E

S

T

A

X

–

R

E

F

U

N

D

R

E

Q

U

E

S

T

Tax Year -

2015

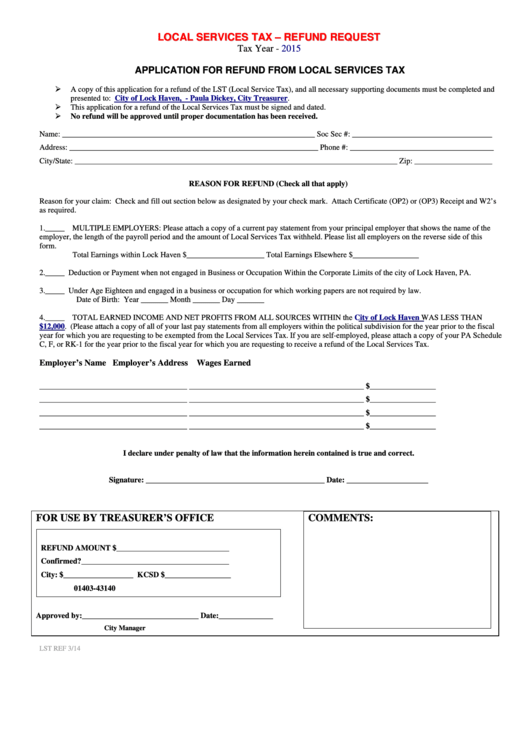

APPLICATION FOR REFUND FROM LOCAL SERVICES TAX

A copy of this application for a refund of the LST (Local Service Tax), and all necessary supporting documents must be completed and

presented to:

City of Lock Haven, - Paula Dickey, City

Treasurer.

This application for a refund of the Local Services Tax must be signed and dated.

No refund will be approved until proper documentation has been received.

Name: _________________________________________________________________ Soc Sec #: ____________________________________

Address: ________________________________________________________________ Phone #: _____________________________________

City/State: ___________________________________________________________________________________ Zip: ____________________

REASON FOR REFUND (Check all that apply)

Reason for your claim: Check and fill out section below as designated by your check mark. Attach Certificate (OP2) or (OP3) Receipt and W2’s

as required.

1._____

MULTIPLE EMPLOYERS: Please attach a copy of a current pay statement from your principal employer that shows the name of the

employer, the length of the payroll period and the amount of Local Services Tax withheld. Please list all employers on the reverse side of this

form.

Total Earnings within Lock Haven $____________________ Total Earnings Elsewhere $_________________

2._____ Deduction or Payment when not engaged in Business or Occupation Within the Corporate Limits of the city of Lock Haven, PA.

3._____ Under Age Eighteen and engaged in a business or occupation for which working papers are not required by law.

Date of Birth: Year _______ Month _______ Day _______

City of Lock Haven

4._____

TOTAL EARNED INCOME AND NET PROFITS FROM ALL SOURCES WITHIN the

WAS LESS THAN

$12,000. (Please attach a copy of all of your last pay statements from all employers within the political subdivision for the year prior to the fiscal

year for which you are requesting to be exempted from the Local Services Tax. If you are self-employed, please attach a copy of your PA Schedule

C, F, or RK-1 for the year prior to the fiscal year for which you are requesting to receive a refund of the Local Services Tax.

Employer’s Name

Employer’s Address

Wages Earned

______________________________________ _____________________________________________

$_________________

______________________________________ _____________________________________________

$_________________

______________________________________ _____________________________________________

$_________________

______________________________________ _____________________________________________

$_________________

I declare under penalty of law that the information herein contained is true and correct.

Signature: ______________________________________________ Date: _____________________

FOR USE BY TREASURER’S OFFICE

COMMENTS:

REFUND AMOUNT $_____________________________

Confirmed?______________________________________

City: $__________________ KCSD $_________________

01403-43140

Approved by:______________________________ Date:______________

City Manager

LST REF 3/14

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1