Form 20 - Declaration Of Estimated Municipal Tax On Net Profits

ADVERTISEMENT

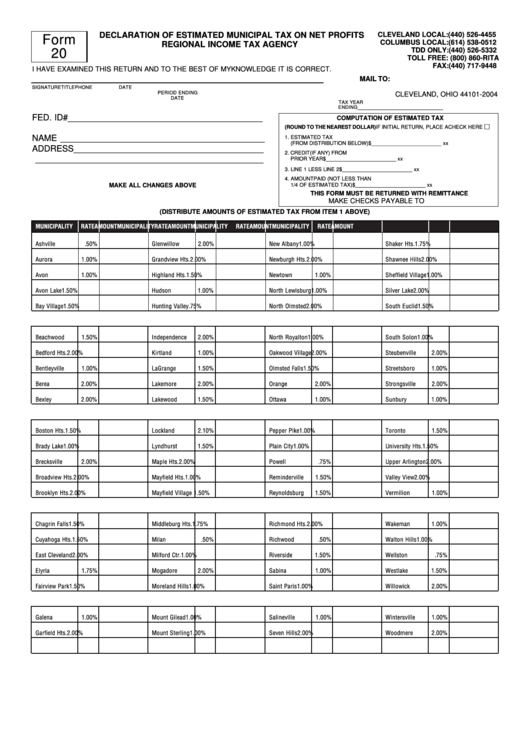

DECLARATION OF ESTIMATED MUNICIPAL TAX ON NET PROFITS

CLEVELAND LOCAL: (440) 526-4455

Form

COLUMBUS LOCAL: (614) 538-0512

REGIONAL INCOME TAX AGENCY

TDD ONLY: (440) 526-5332

20

TOLL FREE: (800) 860-RITA

FAX: (440) 717-9448

I HAVE EXAMINED THIS RETURN AND TO THE BEST OF MY KNOWLEDGE IT IS CORRECT.

MAIL TO: R.I.T.A.

P.O. BOX 6600

SIGNATURE

TITLE

PHONE

DATE

PERIOD ENDING

CLEVELAND, OHIO 44101-2004

DATE

TAX YEAR

_________________________

ENDING

FED. ID# _________________________________________

COMPUTATION OF ESTIMATED TAX

(ROUND TO THE NEAREST DOLLAR) IF INITIAL RETURN, PLACE A CHECK HERE

NAME ___________________________________________

1. ESTIMATED TAX

(FROM DISTRIBUTION BELOW)

$ ________________________ xx

ADDRESS ________________________________________

2. CREDIT (IF ANY) FROM

________________________________________________

PRIOR YEAR

$ ________________________ xx

3. LINE 1 LESS LINE 2

$ ________________________ xx

4. AMOUNT PAID (NOT LESS THAN

1/4 OF ESTIMATED TAX)

$ ________________________ xx

MAKE ALL CHANGES ABOVE

THIS FORM MUST BE RETURNED WITH REMITTANCE

MAKE CHECKS PAYABLE TO R.I.T.A.

(DISTRIBUTE AMOUNTS OF ESTIMATED TAX FROM ITEM 1 ABOVE)

MUNICIPALITY

RATE

AMOUNT

MUNICIPALITY

RATE

AMOUNT

MUNICIPALITY

RATE

AMOUNT

MUNICIPALITY

RATE

AMOUNT

Ashville

.50%

Glenwillow

2.00%

New Albany

1.00%

Shaker Hts.

1.75%

Aurora

1.00%

Grandview Hts.

2.00%

Newburgh Hts.

2.00%

Shawnee Hills

2.00%

Avon

1.00%

Highland Hts.

1.50%

Newtown

1.00%

Sheffield Village 1.00%

Avon Lake

1.50%

Hudson

1.00%

North Lewisburg 1.00%

Silver Lake

2.00%

Bay Village

1.50%

Hunting Valley

.75%

North Olmsted

2.00%

South Euclid

1.50%

Beachwood

1.50%

Independence

2.00%

North Royalton

1.00%

South Solon

1.00%

Bedford Hts.

2.00%

Kirtland

1.00%

Oakwood Village 2.00%

Steubenville

2.00%

Bentleyville

1.00%

LaGrange

1.50%

Olmsted Falls

1.50%

Streetsboro

1.00%

Berea

2.00%

Lakemore

2.00%

Orange

2.00%

Strongsville

2.00%

Sunbury

1.00%

Bexley

2.00%

Lakewood

1.50%

Ottawa

1.00%

Boston Hts.

1.50%

Lockland

2.10%

Pepper Pike

1.00%

Toronto

1.50%

Brady Lake

1.00%

Lyndhurst

1.50%

Plain City

1.00%

University Hts.

1.50%

Brecksville

2.00%

Maple Hts.

2.00%

Powell

.75%

Upper Arlington 2.00%

Broadview Hts.

2.00%

Mayfield Hts.

1.00%

Reminderville

1.50%

Valley View

2.00%

Brooklyn Hts.

2.00%

Mayfield Village

1.50%

Reynoldsburg

1.50%

Vermilion

1.00%

Chagrin Falls

1.50%

Middleburg Hts. 1.75%

Richmond Hts.

2.00%

Wakeman

1.00%

Cuyahoga Hts.

1.50%

Milan

.50%

Richwood

.50%

Walton Hills

1.00%

East Cleveland

2.00%

Milford Ctr.

1.00%

Riverside

1.50%

Wellston

.75%

Elyria

1.75%

Mogadore

2.00%

Sabina

1.00%

Westlake

1.50%

Fairview Park

1.50%

Moreland Hills

1.00%

Saint Paris

1.00%

Willowick

2.00%

Galena

1.00%

Mount Gilead

1.00%

Salineville

1.00%

Wintersville

1.00%

Garfield Hts.

2.00%

Mount Sterling

1.00%

Seven Hills

2.00%

Woodmere

2.00%

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1