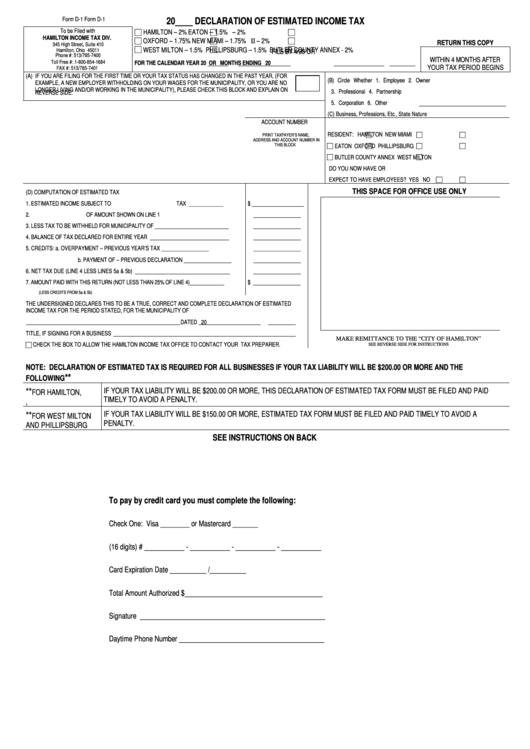

Form D-1 20____ Declaration Of Estimated Income Tax

ADVERTISEMENT

Form D-1

Form D-1

20____ DECLARATION OF ESTIMATED INCOME TAX

.

.

.

To be Filed with

HAMILTON – 2%

EATON – 1.5%

J.E.D.D. – 2%

.

.

.

HAMILTON INCOME TAX DIV.

OXFORD – 1.75%

NEW MIAMI – 1.75%

J.E.D.D. II – 2%

.

.

.

RETURN THIS COPY

345 High Street, Suite 410

WEST MILTON – 1.5%

PHILLIPSBURG – 1.5%

BUTLER COUNTY ANNEX - 2%

Hamilton, Ohio 45011

FILE BY 4/30 OR

Phone #: 513/785-7400

WITHIN 4 MONTHS AFTER

Toll Free #: 1-800-854-1684

FOR THE CALENDAR YEAR 20

OR

MONTHS ENDING

20

YOUR TAX PERIOD BEGINS

FAX #: 513/785-7401

(A) IF YOU ARE FILING FOR THE FIRST TIME OR YOUR TAX STATUS HAS CHANGED IN THE PAST YEAR, (FOR

(B) Circle Whether

1. Employee

2. Owner

EXAMPLE, A NEW EMPLOYER WITHHOLDING ON YOUR WAGES FOR THE MUNICIPALITY, OR YOU ARE NO

LONGER LIVING AND/OR WORKING IN THE MUNICIPALITY), PLEASE CHECK THIS BLOCK AND EXPLAIN ON

3. Professional

4. Partnership

REVERSE SIDE.

5. Corporation

6. Other

(C) Business, Professions, Etc., State Nature

ACCOUNT NUMBER

.

.

.

RESIDENT:

HAMILTON

NEW MIAMI

J.E.D.D.

PRINT TAXPAYER’S NAME,

.

.

.

.

ADDRESS AND ACCOUNT NUMBER IN

THIS BLOCK

EATON

OXFORD

J.E.D.D. II

PHILLIPSBURG

.

.

BUTLER COUNTY ANNEX

WEST MILTON

DO YOU NOW HAVE OR

.

.

EXPECT TO HAVE EMPLOYEES?

YES

NO

THIS SPACE FOR OFFICE USE ONLY

(D) COMPUTATION OF ESTIMATED TAX

1.

ESTIMATED INCOME SUBJECT TO

TAX _____________

$

2.

OF AMOUNT SHOWN ON LINE 1

__________________

3.

LESS TAX TO BE WITHHELD FOR MUNICIPALITY OF ____________________________

__________________

4.

BALANCE OF TAX DECLARED FOR ENTIRE YEAR ______________________________

__________________

5.

CREDITS:

a.

OVERPAYMENT – PREVIOUS YEAR’S TAX __________________

__________________

b.

PAYMENT OF – PREVIOUS DECLARATION __________________

__________________

6.

NET TAX DUE (LINE 4 LESS LINES 5a & 5b) ____________________________________

__________________

7.

AMOUNT PAID WITH THIS RETURN (NOT LESS THAN 25% OF LINE 4) _____________

$ __________________

(LESS CREDITS FROM 5a & 5b)

THE UNDERSIGNED DECLARES THIS TO BE A TRUE, CORRECT AND COMPLETE DECLARATION OF ESTIMATED

INCOME TAX FOR THE PERIOD STATED, FOR THE MUNICIPALITY OF

DATED

20

TITLE, IF SIGNING FOR A BUSINESS

.

MAKE REMITTANCE TO THE “CITY OF HAMILTON”

CHECK THE BOX TO ALLOW THE HAMILTON INCOME TAX OFFICE TO CONTACT YOUR TAX PREPARER.

SEE REVERSE SIDE FOR INSTRUCTIONS

NOTE: DECLARATION OF ESTIMATED TAX IS REQUIRED FOR ALL BUSINESSES IF YOUR TAX LIABILITY WILL BE $200.00 OR MORE AND THE

**

FOLLOWING

IF YOUR TAX LIABILITY WILL BE $200.00 OR MORE, THIS DECLARATION OF ESTIMATED TAX FORM MUST BE FILED AND PAID

**

FOR HAMILTON,

TIMELY TO AVOID A PENALTY.

J.E.D.D., B.C. ANNEX

IF YOUR TAX LIABILITY WILL BE $150.00 OR MORE, ESTIMATED TAX FORM MUST BE FILED AND PAID TIMELY TO AVOID A

**

FOR WEST MILTON

PENALTY.

AND PHILLIPSBURG

SEE INSTRUCTIONS ON BACK

To pay by credit card you must complete the following:

Check One: Visa ________ or Mastercard _______

(16 digits) # ___________ - ___________ - ___________ - ___________

Card Expiration Date __________ /__________

Total Amount Authorized $______________________________________

Signature ___________________________________________________

Daytime Phone Number ________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2