Use your 'Mouse' or the 'Tab' key to move through the fields, use your 'Mouse' or 'Space Bar' to enable the "Check Boxes".

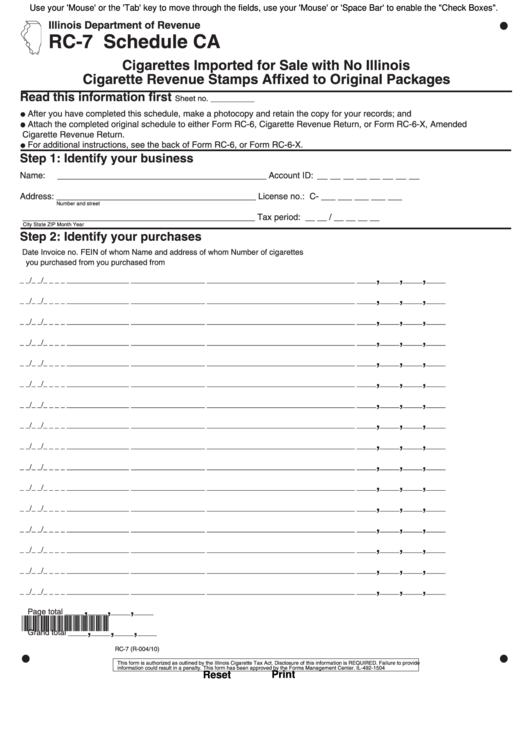

Illinois Department of Revenue

RC-7

Schedule CA

Cigarettes Imported for Sale with No Illinois

Cigarette Revenue Stamps Affixed to Original Packages

Read this information first

Sheet no. __________

After you have completed this schedule, make a photocopy and retain the copy for your records; and

Attach the completed original schedule to either Form RC-6, Cigarette Revenue Return, or Form RC-6-X, Amended

Cigarette Revenue Return.

For additional instructions, see the back of Form RC-6, or Form RC-6-X.

Step 1: Identify your business

Name: ____________________________________________

Account ID: __ __ __ __ __ __ __ __

Address: __________________________________________

License no.: C- ___ ___ ___ ___ ___

Number and street

_________________________________________________

Tax period: __ __ / __ __ __ __

City

State

ZIP

Month

Year

Step 2: Identify your purchases

Date

Invoice no.

FEIN of whom

Name and address of whom

Number of cigarettes

you purchased from

you purchased from

,

,

,

_ _/_ _/_ _ _ _

________________

___________________

______________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

________________

___________________

______________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

________________

___________________

______________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

________________

___________________

______________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

________________

___________________

______________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

________________

___________________

______________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

________________

___________________

______________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

________________

___________________

______________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

________________

___________________

______________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

________________

___________________

______________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

________________

___________________

______________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

________________

___________________

______________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

________________

___________________

______________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

________________

___________________

______________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

________________

___________________

______________________________________

_____

_____

_____

_____

,

,

,

_ _/_ _/_ _ _ _

________________

___________________

______________________________________

_____

_____

_____

_____

,

,

,

Page total

_____

_____

_____

_____

*043801110*

,

,

,

Grand total

_____

_____

_____

_____

RC-7 (R-004/10)

This form is authorized as outlined by the Illinois Cigarette Tax Act. Disclosure of this information is REQUIRED. Failure to provide

information could result in a penalty. This form has been approved by the Forms Management Center.

IL-492-1504

Reset

Print

1

1