Print

Clear

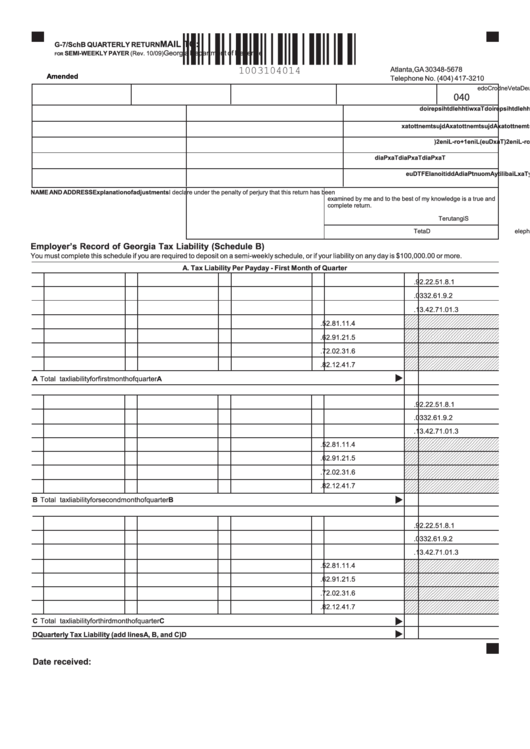

MAIL TO:

G-7/SchB QUARTERLY RETURN

Georgia Department of Revenue

SEMI-WEEKLY PAYER (Rev. 10/09)

FOR

P.O. Box 105678

Atlanta, GA 30348-5678

Amended

Telephone No. (404) 417-3210

G

A

W

i

h t

h

o

d l

n i

g

D I

F

I E

N

u

m

b

r e

P

r e

o i

d

E

n

d

n i

g

D

u

e

D

a

e t

V

e

n

d

r o

C

o

d

e

040

T

a

x

w

i

h t

h

e

d l

h t

s i

p

r e

o i

d

T

a

x

w

i

h t

h

e

d l

h t

s i

p

r e

o i

d

T

a

x

w

i

h t

h

e

d l

h t

s i

p

r e

o i

d

A

d

u j

t s

m

e

t n

o t

a t

x

A

d

u j

t s

m

e

t n

o t

a t

x

A

d

u j

t s

m

e

t n

o t

a t

x

T

a

x

D

u

e

L (

n i

e

1

+

o

- r

L

n i

e

) 2

T

a

x

D

u

e

L (

n i

e

1

+

o

- r

L

n i

e

) 2

T

a

x

D

u

e

L (

n i

e

1

+

o

- r

L

n i

e

) 2

T

a

x

P

a

d i

T

a

x

P

a

d i

T

a

x

P

a

d i

Q

u

a

t r

r e

y l

T

a

x

L

a i

b

i l i

y t

A

m

o

u

t n

P

a

d i

A

d

d

t i

o i

n

l a

E

F

T

D

u

e

NAME AND ADDRESS

Explanation of adjustments

I declare under the penalty of perjury that this return has been

examined by me and to the best of my knowledge is a true and

complete return.

S

g i

n

a

u t

e r

T

itle

D

a

e t

T

elephone

Employer’s Record of Georgia Tax Liability (Schedule B)

You must complete this schedule if you are required to deposit on a semi-weekly schedule, or if your liability on any day is $100,000.00 or more.

A. Tax Liability Per Payday - First Month of Quarter

. 1

. 8

1

. 5

2

. 2

2

. 9

. 2

. 9

1

. 6

2

3

3

. 0

. 3

1

. 0

1

. 7

2

. 4

3

. 1

. 4

1

. 1

1

. 8

2

. 5

. 5

1

. 2

1

. 9

2

. 6

. 6

1

. 3

2

. 0

2

. 7

. 7

1

. 4

2

. 1

2

. 8

A Total tax liability for first month of quarter

A

B. Tax Liability Per Payday - Second Month of Quarter

. 1

. 8

1

. 5

2

. 2

2

. 9

. 2

. 9

1

. 6

2

3

3

. 0

. 3

1

. 0

1

. 7

2

. 4

3

. 1

. 4

1

. 1

1

. 8

2

. 5

. 5

1

. 2

1

. 9

2

. 6

. 6

1

. 3

2

. 0

2

. 7

. 7

1

. 4

2

. 1

2

. 8

B Total tax liability for second month of quarter

B

C. Tax Liability Per Payday - Third Month of Quarter

. 1

. 8

1

. 5

2

. 2

2

. 9

. 2

. 9

1

. 6

2

3

3

. 0

. 3

1

. 0

1

. 7

2

. 4

3

. 1

. 4

1

. 1

1

. 8

2

. 5

. 5

1

. 2

1

. 9

2

. 6

. 6

1

. 3

2

. 0

2

. 7

. 7

1

. 4

2

. 1

2

. 8

C Total tax liability for third month of quarter

C

D Quarterly Tax Liability (add lines A, B, and C)

D

Date received:

1

1