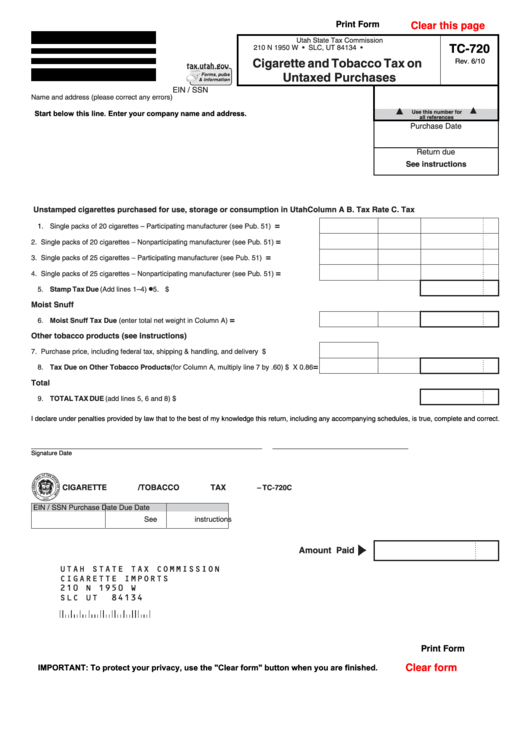

Clear this page

Print Form

Utah State Tax Commission

TC-720

210 N 1950 W • SLC, UT 84134 •

Cigarette and Tobacco Tax on

Rev. 6/10

Untaxed Purchases

EIN / SSN

Name and address (please correct any errors)

Start below this line. Enter your company name and address.

Use this number for

all references

Purchase Date

Return due

See instructions

Unstamped cigarettes purchased for use, storage or consumption in Utah

Column A

B. Tax Rate

C. Tax

=

1.

Single packs of 20 cigarettes – Participating manufacturer (see Pub. 51) ..................

1.

X 1.70

=

2. Single packs of 20 cigarettes – Nonparticipating manufacturer (see Pub. 51) ............

2.

X 2.05

=

3. Single packs of 25 cigarettes – Participating manufacturer (see Pub. 51) ..................

3.

X 2.125

=

4. Single packs of 25 cigarettes – Nonparticipating manufacturer (see Pub. 51) ............

4.

X 2.5625

•

....................................................................................................................

5. Stamp Tax Due (Add lines 1–4)

5. $

Moist Snuff

=

6. Moist Snuff Tax Due (enter total net weight in Column A) .........................................

6.

oz. X 1.83

Other tobacco products (see instructions)

7. Purchase price, including federal tax, shipping & handling, and delivery fees ............

7. $

=

8. Tax Due on Other Tobacco Products (for Column A, multiply line 7 by .60) ............

8. $

X 0.86

Total

9. TOTAL TAX DUE (add lines 5, 6 and 8) .......................................................................................................................

9. $

I declare under penalties provided by law that to the best of my knowledge this return, including any accompanying schedules, is true, complete and correct.

_______ _____________________ _____________

__ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Signature

Date

CIGARETTE /TOBACCO TAX

– TC-720C

EIN / SSN

Purchase Date

Due Date

See instructions

Amount Paid

UTAH STATE TAX COMMISSION

CIGARETTE IMPORTS

210 N 1950 W

SLC UT

84134

Print Form

IMPORTANT: To protect your privacy, use the "Clear form" button when you are finished.

Clear form

1

1 2

2 3

3