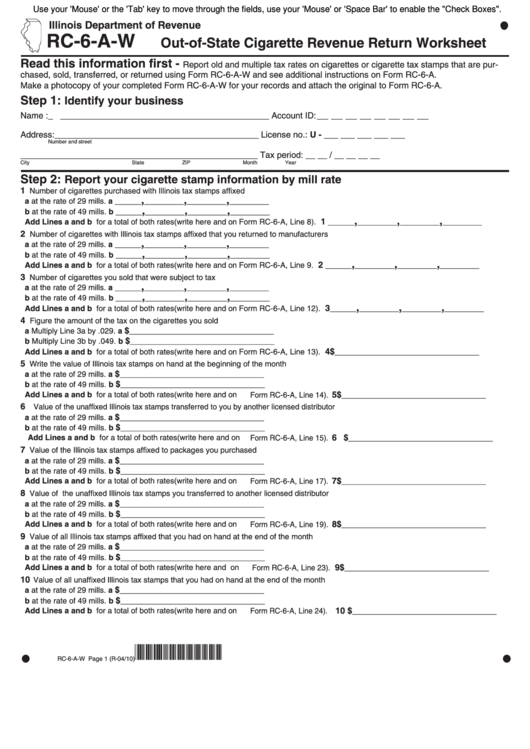

Use your 'Mouse' or the 'Tab' key to move through the fields, use your 'Mouse' or 'Space Bar' to enable the "Check Boxes".

Illinois Department of Revenue

RC-6-A-W

Out-of-State Cigarette Revenue Return Worksheet

Read this information first -

Report old and multiple tax rates on cigarettes or cigarette tax stamps that are pur-

chased, sold, transferred, or returned using Form RC-6-A-W and see additional instructions on Form RC-6-A.

Make a photocopy of your completed Form RC-6-A-W for your records and attach the original to Form RC-6-A.

Step 1:

Identify your business

Name : _ _ ___________________________________________ Account ID: __ __ __ __ __ __ __ __

Address:___________________________________________ License no.: U - ___ ___ ___ ___ ___

Number and street

__________________________________________________ Tax period: __ __ / __ __ __ __

City State

ZIP

Month Year

Step 2:

Report your cigarette stamp information by mill rate

1

Number of cigarettes purchased with Illinois tax stamps affixed

,

,

,

a at the rate of 29 mills.

a ______

_________

_________

_________

,

,

,

b at the rate of 49 mills.

b ______

_________

_________

_________

,

,

,

1

Add Lines a and b for a total of both rates (write here and on Form RC-6-A, Line 8).

______

_________

_________

_________

2

Number of cigarettes with Illinois tax stamps affixed that you returned to manufacturers

,

,

,

a at the rate of 29 mills.

a ______

_________

_________

_________

,

,

,

b at the rate of 49 mills.

b ______

_________

_________

_________

,

,

,

2

Add Lines a and b for a total of both rates (write here and on Form RC-6-A, Line 9.

______

_________

_________

_________

3

Number of cigarettes you sold that were subject to tax

,

,

,

a at the rate of 29 mills.

a ______

_________

_________

_________

,

,

,

b at the rate of 49 mills.

b ______

_________

_________

_________

,

,

,

3

Add Lines a and b for a total of both rates (write here and on Form RC-6-A, Line 12).

______

_________

_________

_________

4

Figure the amount of the tax on the cigarettes you sold

$

a Multiply Line 3a by .029.

a

_________________________________

$

b Multiply Line 3b by .049.

b

_________________________________

4 $

Add Lines a and b for a total of both rates (write here and on Form RC-6-A, Line 13).

_________________________________

5

Write the value of Illinois tax stamps on hand at the beginning of the month

$

a at the rate of 29 mills.

a

_________________________________

$

b at the rate of 49 mills.

b

_________________________________

5 $

Add Lines a and b for a total of both rates (write here and on Form RC-6-A, Line 14).

_________________________________

6

Value of the unaffixed Illinois tax stamps transferred to you by another licensed distributor

$

a at the rate of 29 mills.

a

_________________________________

$

b at the rate of 49 mills.

b

_________________________________

6 $

Add Lines a and b for a total of both rates (write here and on Form RC-6-A, Line 15).

_________________________________

7

Value of the Illinois tax stamps affixed to packages you purchased

$

a at the rate of 29 mills.

a

_________________________________

$

b at the rate of 49 mills.

b

_________________________________

7 $

Add Lines a and b for a total of both rates (write here and on Form RC-6-A, Line 17).

_________________________________

8

Value of the unaffixed Illinois tax stamps you transferred to another licensed distributor

$

a at the rate of 29 mills.

a

_________________________________

$

b at the rate of 49 mills.

b

_________________________________

8 $

Add Lines a and b for a total of both rates (write here and on Form RC-6-A, Line 19).

_________________________________

9

Value of all Illinois tax stamps affixed that you had on hand at the end of the month

$

a at the rate of 29 mills.

a

_________________________________

$

b at the rate of 49 mills.

b

_________________________________

9 $

Add Lines a and b for a total of both rates (write here and on Form RC-6-A, Line 23).

_________________________________

10

Value of all unaffixed Illinois tax stamps that you had on hand at the end of the month

$

a at the rate of 29 mills.

a

_________________________________

$

b at the rate of 49 mills.

b

_________________________________

10 $

Add Lines a and b for a total of both rates (write here and on Form RC-6-A, Line 24).

_________________________________

*043401110*

RC-6-A-W Page 1 (R-04/10)

1

1 2

2