Fy 2006-01 - Informational Bulletin Template - Illinois Department Of Revenue

ADVERTISEMENT

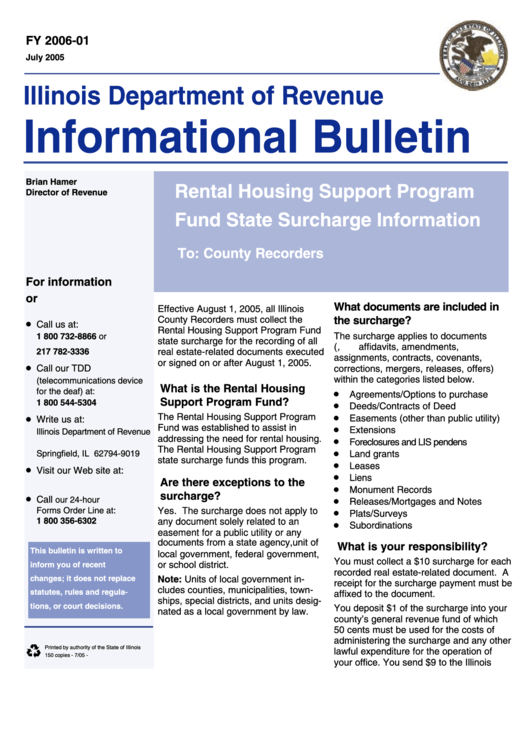

FY 2006-01

July 2005

Illinois Department of Revenue

Informational Bulletin

Brian Hamer

Rental Housing Support Program

Director of Revenue

Fund State Surcharge Information

To: County Recorders

For information

or forms...

What documents are included in

Effective August 1, 2005, all Illinois

County Recorders must collect the

the surcharge?

Call us at:

Rental Housing Support Program Fund

The surcharge applies to documents

1 800 732-8866 or

state surcharge for the recording of all

( e.g., affidavits, amendments,

217 782-3336

real estate-related documents executed

assignments, contracts, covenants,

or signed on or after August 1, 2005.

Call our TDD

corrections, mergers, releases, offers)

within the categories listed below.

(telecommunications device

What is the Rental Housing

for the deaf) at:

Agreements/Options to purchase

Support Program Fund?

1 800 544-5304

Deeds/Contracts of Deed

The Rental Housing Support Program

Easements (other than public utility)

Write us at:

Fund was established to assist in

Extensions

Illinois Department of Revenue

addressing the need for rental housing.

Foreclosures and LIS pendens

P.O. Box 19019

The Rental Housing Support Program

Springfield, IL 62794-9019

Land grants

state surcharge funds this program.

Leases

Visit our Web site at:

Liens

Are there exceptions to the

Monument Records

surcharge?

Call

our 24-hour

Releases/Mortgages and Notes

Forms Order Line at:

Yes. The surcharge does not apply to

Plats/Surveys

1 800 356-6302

any document solely related to an

Subordinations

easement for a public utility or any

documents from a state agency, unit of

What is your responsibility?

This bulletin is written to

local government, federal government,

You must collect a $10 surcharge for each

or school district.

inform you of recent

recorded real estate-related document. A

changes; it does not replace

Note: Units of local government in-

receipt for the surcharge payment must be

cludes counties, municipalities, town-

statutes, rules and regula-

affixed to the document.

ships, special districts, and units desig-

tions, or court decisions.

You deposit $1 of the surcharge into your

nated as a local government by law.

county’s general revenue fund of which

50 cents must be used for the costs of

administering the surcharge and any other

Printed by authority of the State of Illinois

lawful expenditure for the operation of

150 copies - 7/05 - P.O. Number 2060009

your office. You send $9 to the Illinois

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2