Form St-15 - Business Information Update - Illinois Department Of Revenue

ADVERTISEMENT

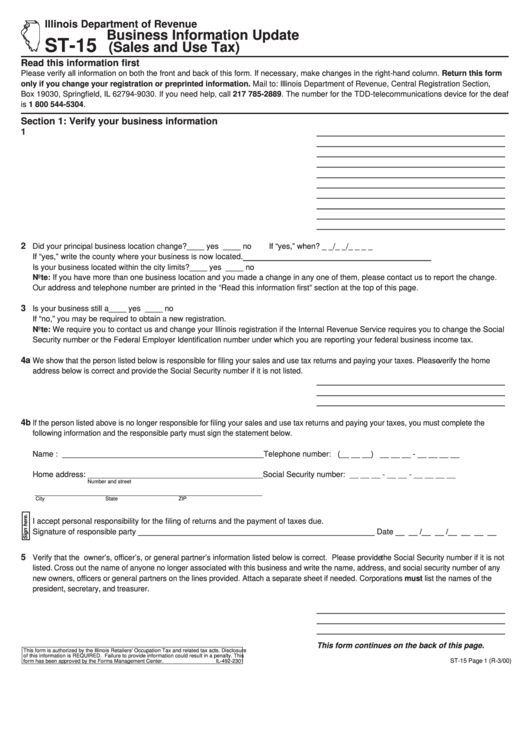

Illinois Department of Revenue

Business Information Update

ST-15

(Sales and Use Tax)

Read this information first

Please verify all information on both the front and back of this form. If necessary, make changes in the right-hand column. Return this form

only if you change your registration or preprinted information. Mail to: Illinois Department of Revenue, Central Registration Section, P.O.

Box 19030, Springfield, IL 62794-9030. If you need help, call 217 785-2889. The number for the TDD-telecommunications device for the deaf

is 1 800 544-5304.

Section 1: Verify your business information

____________________________________

1

____________________________________

____________________________________

____________________________________

____________________________________

____________________________________

____________________________________

____________________________________

____________________________________

____________________________________

2

Did your principal business location change?

____ yes ____ no

If “yes,” when? _ _/_ _/_ _ _ _

____________________________________

If “yes,” write the county where your business is now located.

Is your business located within the city limits?

____ yes ____ no

Note: If you have more than one business location and you made a change in any one of them, please contact us to report the change.

Our address and telephone number are printed in the “Read this information first” section at the top of this page.

3

Is your business still a

____ yes ____ no

If “no,” you may be required to obtain a new registration.

Note: We require you to contact us and change your Illinois registration if the Internal Revenue Service requires you to change the Social

Security number or the Federal Employer Identification number under which you are reporting your federal business income tax.

4a

We show that the person listed below is responsible for filing your sales and use tax returns and paying your taxes. Please verify the home

address below is correct and provide the Social Security number if it is not listed.

____________________________________

____________________________________

____________________________________

4b

If the person listed above is no longer responsible for filing your sales and use tax returns and paying your taxes, you must complete the

following information and the responsible party must sign the statement below.

Name : ______________________________________________

Telephone number: (__ __ __) __ __ __ - __ __ __ __

Home address: ________________________________________

Social Security number: __ __ __ - __ __ - __ __ __ __

Number and street

____________________________________________________

City

State

ZIP

I accept personal responsibility for the filing of returns and the payment of taxes due.

Signature of responsible party ______________________________________________________ Date __ __ /__ __ /__ __ __ __

5

Verify that the owner’s, officer’s, or general partner’s information listed below is correct. Please provide the Social Security number if it is not

listed. Cross out the name of anyone no longer associated with this business and write the name, address, and social security number of any

new owners, officers or general partners on the lines provided. Attach a separate sheet if needed. Corporations must list the names of the

president, secretary, and treasurer.

____________________________________

____________________________________

____________________________________

This form continues on the back of this page.

This form is authorized by the Illinois Retailers' Occupation Tax and related tax acts. Disclosure

of this information is REQUIRED. Failure to provide information could result in a penalty. This

ST-15 Page 1 (R-3/00)

form has been approved by the Forms Management Center.

IL-492-2301

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4