Fy 2011-11 - Informational Bulletin - Illinois Department Of Revenue

ADVERTISEMENT

FY 2011-11

Illinois Department of Revenue

April 2011

i

nformational

Bulletin

Brian Hamer / Director

Simplifi ed Municipal

Telecommunications Tax Rate

Changes Effective July 1, 2011

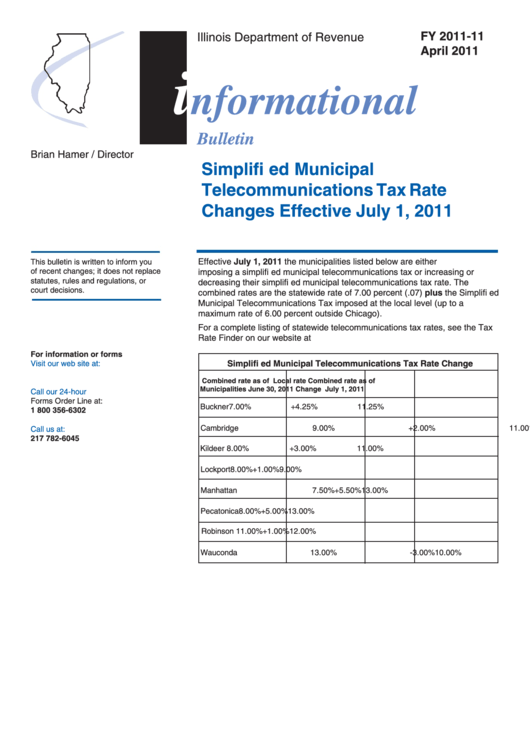

Effective July 1, 2011 the municipalities listed below are either

This bulletin is written to inform you

of recent changes; it does not replace

imposing a simplifi ed municipal telecommunications tax or increasing or

statutes, rules and regulations, or

decreasing their simplifi ed municipal telecommunications tax rate. The

court decisions.

combined rates are the statewide rate of 7.00 percent (.07) plus the Simplifi ed

Municipal Telecommunications Tax imposed at the local level (up to a

maximum rate of 6.00 percent outside Chicago).

For a complete listing of statewide telecommunications tax rates, see the Tax

Rate Finder on our website at tax.illinois.gov.

For information or forms

Simplifi ed Municipal Telecommunications Tax Rate Change

Visit our web site at:

tax.illinois.gov

Combined rate as of

Local rate

Combined rate as of

Municipalities

June 30, 2011

Change

July 1, 2011

Call our 24-hour

Forms Order Line at:

Buckner

7.00%

+4.25%

11.25%

1 800 356-6302

Cambridge

9.00%

+2.00%

11.00%

Call us at:

217 782-6045

Kildeer

8.00%

+3.00%

11.00%

Lockport

8.00%

+1.00%

9.00%

Manhattan

7.50%

+5.50%

13.00%

Pecatonica

8.00%

+5.00%

13.00%

Robinson

11.00%

+1.00%

12.00%

Wauconda

13.00%

-3.00%

10.00%

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1