1999 Survey Of Tax Professionals Form - Maine Revenue Services

ADVERTISEMENT

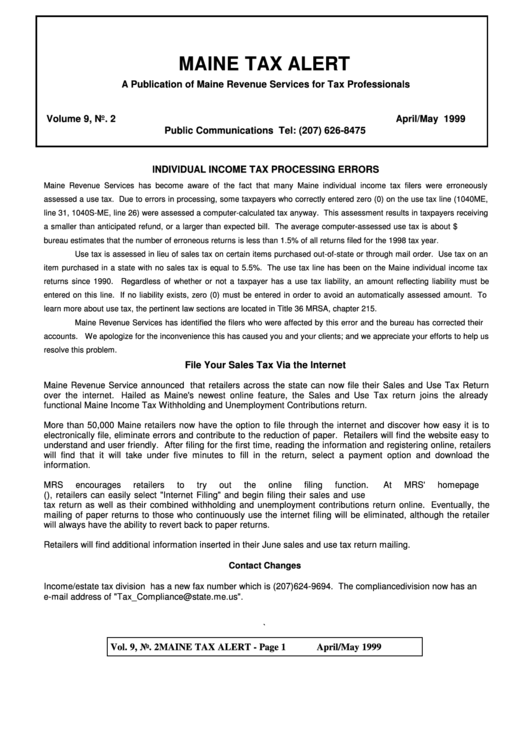

MAINE TAX ALERT

A Publication of Maine Revenue Services for Tax Professionals

Volume 9, No. 2

April/May 1999

Public Communications Tel: (207) 626-8475

INDIVIDUAL INCOME TAX PROCESSING ERRORS

Maine Revenue Services has become aware of the fact that many Maine individual income tax filers were erroneously

assessed a use tax. Due to errors in processing, some taxpayers who correctly entered zero (0) on the use tax line (1040ME,

line 31, 1040S-ME, line 26) were assessed a computer-calculated tax anyway. This assessment results in taxpayers receiving

a smaller than anticipated refund, or a larger than expected bill. The average computer-assessed use tax is about $15. The

bureau estimates that the number of erroneous returns is less than 1.5% of all returns filed for the 1998 tax year.

Use tax is assessed in lieu of sales tax on certain items purchased out-of-state or through mail order. Use tax on an

item purchased in a state with no sales tax is equal to 5.5%. The use tax line has been on the Maine individual income tax

returns since 1990. Regardless of whether or not a taxpayer has a use tax liability, an amount reflecting liability must be

entered on this line. If no liability exists, zero (0) must be entered in order to avoid an automatically assessed amount. To

learn more about use tax, the pertinent law sections are located in Title 36 MRSA, chapter 215.

Maine Revenue Services has identified the filers who were affected by this error and the bureau has corrected their

accounts. We apologize for the inconvenience this has caused you and your clients; and we appreciate your efforts to help us

resolve this problem.

File Your Sales Tax Via the Internet

Maine Revenue Service announced that retailers across the state can now file their Sales and Use Tax Return

over the internet. Hailed as Maine's newest online feature, the Sales and Use Tax return joins the already

functional Maine Income Tax Withholding and Unemployment Contributions return.

More than 50,000 Maine retailers now have the option to file through the internet and discover how easy it is to

electronically file, eliminate errors and contribute to the reduction of paper. Retailers will find the website easy to

understand and user friendly. After filing for the first time, reading the information and registering online, retailers

will find that it will take under five minutes to fill in the return, select a payment option and download the

information.

MRS

encourages

retailers

to

try

out

the

online

filing

function.

At

MRS'

homepage

( ), retailers can easily select "Internet Filing" and begin filing their sales and use

tax return as well as their combined withholding and unemployment contributions return online. Eventually, the

mailing of paper returns to those who continuously use the internet filing will be eliminated, although the retailer

will always have the ability to revert back to paper returns.

Retailers will find additional information inserted in their June sales and use tax return mailing.

Contact Changes

Income/estate tax division has a new fax number which is (207)624-9694. The compliance division now has an

e-mail address of "Tax_Compliance@state.me.us".

`

Vol. 9, No. 2

MAINE TAX ALERT - Page 1

April/May 1999

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4