Form Ab-56a - Application For Tax Exemption And Reduction For The Remodeling, Reconstruction Or Expansion Of Existing Commercial Buildings Or Structures

ADVERTISEMENT

MONTANA

AB-56A

Rev 10 12

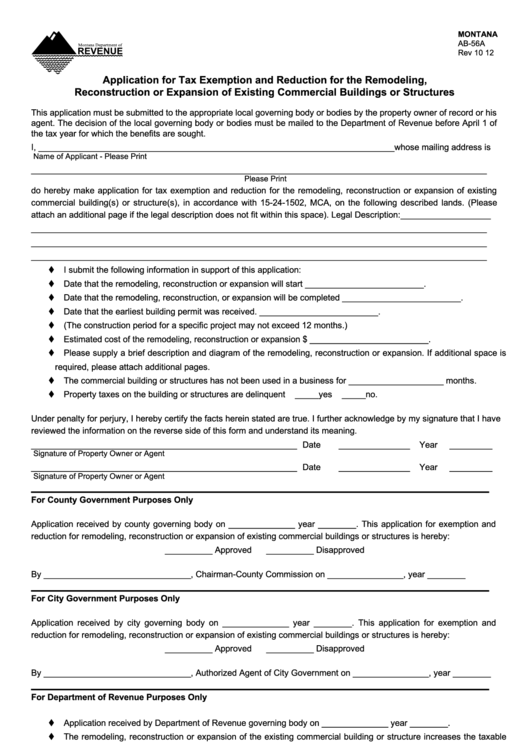

Application for Tax Exemption and Reduction for the Remodeling,

Reconstruction or Expansion of Existing Commercial Buildings or Structures

This application must be submitted to the appropriate local governing body or bodies by the property owner of record or his

agent. The decision of the local governing body or bodies must be mailed to the Department of Revenue before April 1 of

the tax year for which the benefits are sought.

I, ___________________________________________________________________________whose mailing address is

Name of Applicant - Please Print

________________________________________________________________________________________________

Please Print

do hereby make application for tax exemption and reduction for the remodeling, reconstruction or expansion of existing

commercial building(s) or structure(s), in accordance with 15-24-1502, MCA, on the following described lands. (Please

attach an additional page if the legal description does not fit within this space). Legal Description: ___________________

________________________________________________________________________________________________

________________________________________________________________________________________________

________________________________________________________________________________________________

I submit the following information in support of this application:

Date that the remodeling, reconstruction or expansion will start _________________________.

Date that the remodeling, reconstruction, or expansion will be completed _________________________.

Date that the earliest building permit was received. _________________________.

(The construction period for a specific project may not exceed 12 months.)

Estimated cost of the remodeling, reconstruction or expansion $ _________________________.

Please supply a brief description and diagram of the remodeling, reconstruction or expansion. If additional space is

required, please attach additional pages.

The commercial building or structures has not been used in a business for ____________________ months.

Property taxes on the building or structures are delinquent

_____yes

_____no.

Under penalty for perjury, I hereby certify the facts herein stated are true. I further acknowledge by my signature that I have

reviewed the information on the reverse side of this form and understand its meaning.

________________________________________________________

Date _______________

Year _________

Signature of Property Owner or Agent

________________________________________________________

Date _______________

Year _________

Signature of Property Owner or Agent

_____________________________________________________

For County Government Purposes Only

Application received by county governing body on ______________ year ________. This application for exemption and

reduction for remodeling, reconstruction or expansion of existing commercial buildings or structures is hereby:

__________ Approved

__________ Disapproved

By _______________________________, Chairman-County Commission on ________________, year ________

_____________________________________________________

For City Government Purposes Only

Application received by city governing body on ______________ year ________. This application for exemption and

reduction for remodeling, reconstruction or expansion of existing commercial buildings or structures is hereby:

__________ Approved

__________ Disapproved

By _______________________________, Authorized Agent of City Government on ________________, year ________

_____________________________________________________

For Department of Revenue Purposes Only

Application received by Department of Revenue governing body on ______________ year ________.

The remodeling, reconstruction or expansion of the existing commercial building or structure increases the taxable

value of that structure or building by at least 5%

_____yes

_____no.

This application for tax exemption and reduction for the remodeling, reconstruction, or expansion of existing commercial

buildings or structures is hereby __________ Approved

__________ Disapproved

If approved, the appropriate tax benefits will be granted for the ________ tax year.

By ___________________________________________, County Appraiser on ________________, year ________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2