Form Au-550 - Application For Credit For Reduced Rate Petroleum Products - State Of Connecticut Department Of Revenue Services

ADVERTISEMENT

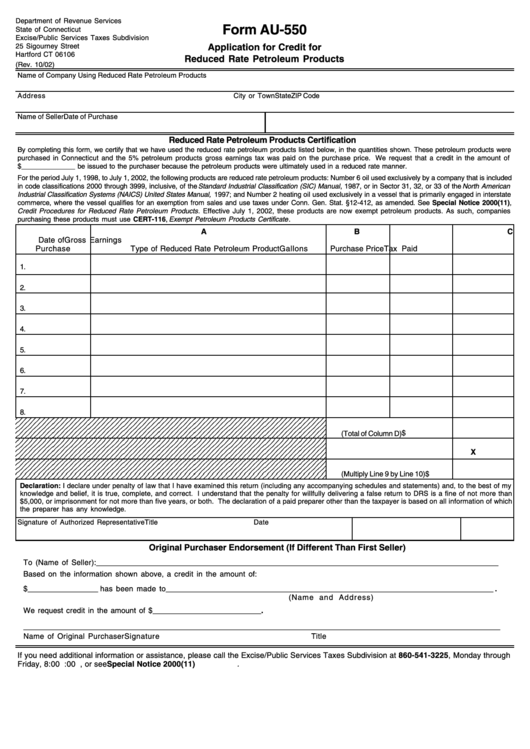

Department of Revenue Services

Form AU-550

State of Connecticut

Excise/Public Services Taxes Subdivision

25 Sigourney Street

Application for Credit for

Hartford CT 06106

Reduced Rate Petroleum Products

(Rev. 10/02)

Name of Company Using Reduced Rate Petroleum Products

Address

City or Town

State

ZIP Code

Name of Seller

Date of Purchase

Reduced Rate Petroleum Products Certification

By completing this form, we certify that we have used the reduced rate petroleum products listed below, in the quantities shown. These petroleum products were

purchased in Connecticut and the 5% petroleum products gross earnings tax was paid on the purchase price. We request that a credit in the amount of

$______________ be issued to the purchaser because the petroleum products were ultimately used in a reduced rate manner.

For the period July 1, 1998, to July 1, 2002, the following products are reduced rate petroleum products: Number 6 oil used exclusively by a company that is included

in code classifications 2000 through 3999, inclusive, of the Standard Industrial Classification (SIC) Manual , 1987, or in Sector 31, 32, or 33 of the North American

Industrial Classification Systems (NAICS) United States Manual, 1997; and Number 2 heating oil used exclusively in a vessel that is primarily engaged in interstate

commerce, where the vessel qualifies for an exemption from sales and use taxes under Conn. Gen. Stat. §12-412, as amended. See Special Notice 2000(11),

Credit Procedures for Reduced Rate Petroleum Products . Effective July 1, 2002, these products are now exempt petroleum products. As such, companies

purchasing these products must use CERT-116, Exempt Petroleum Products Certificate .

A

B

C

D

Date of

Gross Earnings

Purchase

Type of Reduced Rate Petroleum Product

Gallons

Purchase Price

Tax Paid

1.

2.

3.

4.

5.

6.

7.

8.

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5

9. Total Gross Earnings Tax Paid

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5

$

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5

(Total of Column D)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5

X

10. Insert Applicable Rate

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5

11. Total Amount of Credit Due

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5

(Multiply Line 9 by Line 10)

$

Declaration: I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best of my

knowledge and belief, it is true, complete, and correct. I understand that the penalty for willfully delivering a false return to DRS is a fine of not more than

$5,000, or imprisonment for not more than five years, or both. The declaration of a paid preparer other than the taxpayer is based on all information of which

the preparer has any knowledge.

Signature of Authorized Representative

Title

Date

Original Purchaser Endorsement (If Different Than First Seller)

To (Name of Seller): _________________________________________________________________________________________________

Based on the information shown above, a credit in the amount of:

$ _________________ has been made to _______________________________________________________________________________ .

(Name and Address)

We request credit in the amount of $ __________________________ .

___________________________________________________________________________________________________________________

Name of Original Purchaser

Signature

Title

If you need additional information or assistance, please call the Excise/Public Services Taxes Subdivision at 860-541-3225, Monday through

Friday, 8:00 a.m. to 5:00 p.m., or see Special Notice 2000(11) .

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1