Form Au-474 - Application For Refund Of The Petroleum Business Tax Because Of A Bad Debt

ADVERTISEMENT

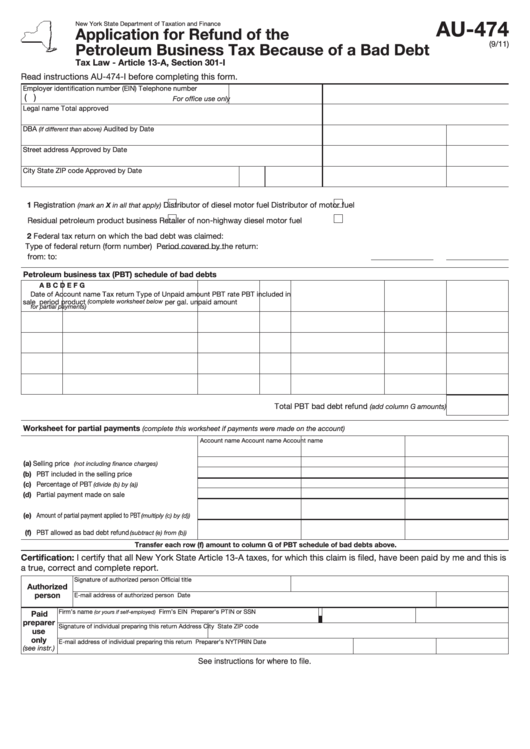

AU-474

New York State Department of Taxation and Finance

Application for Refund of the

(9/11)

Petroleum Business Tax Because of a Bad Debt

Tax Law - Article 13-A, Section 301-I

Read instructions AU-474-I before completing this form.

Employer identification number (EIN)

Telephone number

(

)

For office use only

Legal name

Total approved

DBA

Audited by

Date

(if different than above)

Street address

Approved by

Date

City

State

ZIP code

Approved by

Date

1 Registration

Distributor of diesel motor fuel

Distributor of motor fuel

(mark an X in all that apply)

Residual petroleum product business

Retailer of non-highway diesel motor fuel

2 Federal tax return on which the bad debt was claimed:

Type of federal return (form number)

Period covered by the return:

from:

to:

Petroleum business tax (PBT) schedule of bad debts

A

B

C

D

E

F

G

Date of

Account name

Tax return

Type of

Unpaid amount

PBT rate

PBT included in

sale

period

product

(complete worksheet below

per gal.

unpaid amount

for partial payments)

Total PBT bad debt refund

(add column G amounts)

Worksheet for partial payments

(complete this worksheet if payments were made on the account)

Account name

Account name

Account name

(a) Selling price

....................

(not including finance charges)

(b) PBT included in the selling price .................................

(c) Percentage of PBT

..............................

(divide (b) by (a))

(d) Partial payment made on sale .....................................

(e) Amount of partial payment applied to PBT

(multiply (c) by (d))

(f) PBT allowed as bad debt refund

....

(subtract (e) from (b))

Transfer each row (f) amount to column G of PBT schedule of bad debts above.

Certification: I certify that all New York State Article 13-A taxes, for which this claim is filed, have been paid by me and this is

a true, correct and complete report.

Signature of authorized person

Official title

Authorized

person

E-mail address of authorized person

Date

Firm’s name

Firm’s EIN

Preparer’s PTIN or SSN

(or yours if self-employed)

Paid

preparer

Signature of individual preparing this return

Address

City

State

ZIP code

use

only

E-mail address of individual preparing this return

Preparer’s NYTPRIN

Date

(see instr.)

See instructions for where to file.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1