Direct Payment Authorization Form

Download a blank fillable Direct Payment Authorization Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Direct Payment Authorization Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

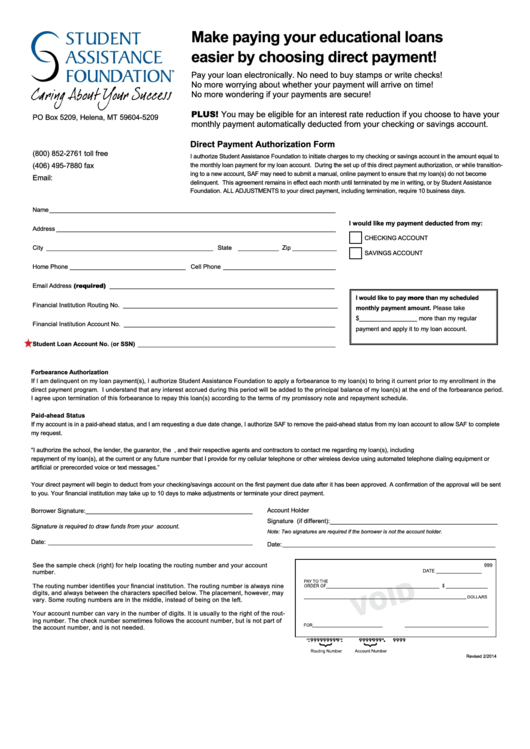

Make paying your educational loans

easier by choosing direct payment!

Pay your loan electronically. No need to buy stamps or write checks!

No more worrying about whether your payment will arrive on time!

No more wondering if your payments are secure!

PLUS! You may be eligible for an interest rate reduction if you choose to have your

PO Box 5209, Helena, MT 59604-5209

monthly payment automatically deducted from your checking or savings account.

Direct Payment Authorization Form

(800) 852-2761 toll free

I authorize Student Assistance Foundation to initiate charges to my checking or savings account in the amount equal to

(406) 495-7880 fax

the monthly loan payment for my loan account. During the set up of this direct payment authorization, or while transition-

ing to a new account, SAF may need to submit a manual, online payment to ensure that my loan(s) do not become

Email: customerservice@

delinquent. This agreement remains in effect each month until terminated by me in writing, or by Student Assistance

Foundation. ALL ADJUSTMENTS to your direct payment, including termination, require 10 business days.

Name ____________________________________________________________________________________

I would like my payment deducted from my:

Address __________________________________________________________________________________

CHECKING ACCOUNT

City _________________________________________________ State ____________ Zip _____________

SAVINGS ACCOUNT

Home Phone __________________________________ Cell Phone _________________________________

Email Address (required) __________________________________________________________________

I would like to pay more than my scheduled

Financial Institution Routing No. _______________________________________________________________

monthly payment amount. Please take

$_________________ more than my regular

Financial Institution Account No. ______________________________________________________________

payment and apply it to my loan account.

Student Loan Account No. (or SSN) __________________________________________________________

Forbearance Authorization

If I am delinquent on my loan payment(s), I authorize Student Assistance Foundation to apply a forbearance to my loan(s) to bring it current prior to my enrollment in the

direct payment program. I understand that any interest accrued during this period will be added to the principal balance of my loan(s) at the end of the forbearance period.

I agree upon termination of this forbearance to repay this loan(s) according to the terms of my promissory note and repayment schedule.

Paid-ahead Status

If my account is in a paid-ahead status, and I am requesting a due date change, I authorize SAF to remove the paid-ahead status from my loan account to allow SAF to complete

my request.

“I authorize the school, the lender, the guarantor, the U.S. Department of Education, and their respective agents and contractors to contact me regarding my loan(s), including

repayment of my loan(s), at the current or any future number that I provide for my cellular telephone or other wireless device using automated telephone dialing equipment or

artificial or prerecorded voice or text messages.”

Your direct payment will begin to deduct from your checking/savings account on the first payment due date after it has been approved. A confirmation of the approval will be sent

to you. Your financial institution may take up to 10 days to make adjustments or terminate your direct payment.

Account Holder

Borrower Signature: _________________________________________________

___________________________________________

Signature (if different):

Signature is required to draw funds from your account.

Note: Two signatures are required if the borrower is not the account holder.

Date: ____________________________________________________________

Date: ______________________________________________________________________

See the sample check (right) for help locating the routing number and your account

number.

The routing number identifies your financial institution. The routing number is always nine

digits, and always between the characters specified below. The placement, however, may

vary. Some routing numbers are in the middle, instead of being on the left.

Your account number can vary in the number of digits. It is usually to the right of the rout-

ing number. The check number sometimes follows the account number, but is not part of

the account number, and is not needed.

Revised 2/2014

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1