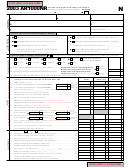

ITNR152

NR2

Primary SSN _______- _____- ________

(A)

Your/Joint

(B) Spouse’s Income

Income

Status 4 Only

00

00

24.

ADJUSTED GROSS INCOME: (From Line 23, Columns A and B) ..............................24

���

6HOHFW WD[ WDEOH� (Check the appropriate box)

LOW INCOME 7DEOH

REGULAR 7DEOH

,I \RX TXDOLI\ IRU WKH /RZ ,QFRPH 7D[ 7DEOH� HQWHU ]HUR ��� RQ /LQH ��$� ,I QRW� WKHQ�

}

Enter

Itemized Deductions (See Instructions, Line 25 and

attach AR3)

the larger

25

,I \RXU VSRXVH LWHPL]HV RQ D VHSDUDWH UHWXUQ� FKHFN KHUH

00

00

of your:

Standard Deduction (See Instructions, Line 25) .........................25

25

00

00

26.

NET TAXABLE INCOME: (Subtract Line 25 from Line 24) ..........................................26

26

00

00

27.

TAX: (Enter tax from tax table) ..........................................................................................27

27

00

���

&RPELQHG WD[� (Add amounts from Line 27, Columns A and B) ......................................................................................28

00

���

(QWHU WD[ IURP /XPS 6XP 'LVWULEXWLRQ $YHUDJLQJ 6FKHGXOH�

(Attach AR1000TD)

.......................................................... 29

00

���

$GGLWLRQDO WD[ RQ ,5$ DQG TXDOL¿HG SODQ ZLWKGUDZDO DQG RYHUSD\PHQW�

(Attach federal Form 5329, if required)

............ 30

00

31.

TOTAL TAX: (Add Lines 28 through 30) ......................................................................................................................31

00

���

3HUVRQDO 7D[ &UHGLW�V�� (Enter total from Line 7D) .............................................................32

00

33.

Child Care Credit:

(20% of federal credit allowed; Attach federal Form 2441)

..........................33

00

34.

Other Credits:

(Attach AR1000TC)

.....................................................................................34

35.

TOTAL CREDITS: (Add Lines 32 through 34) .............................................................................................................35

00

00

36.

NET TAX: (Subtract Line 35 from Line 31. If Line 35 is greater than Line 31, enter 0) ................................................ 36

00

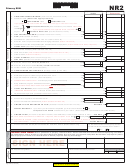

36A. Enter the amount from Line 23, Column C: ............................................................... 36A

00

36B. Enter the total amount from Line 23, Columns A and B: ......................................... 36B

36C. Divide Line 36A by 36B: (See Instructions) ...................................................................................................................

36C

00

36D. APPORTIONED TAX LIABILITY: (Multiply Line 36 by Line 36C) .........................................................................

36D

00

���

$UNDQVDV LQFRPH WD[ ZLWKKHOG�

[Attach state copies of W-2 and/or 1099R Form(s)]

.........37

00

���

(VWLPDWHG WD[ SDLG RU FUHGLW EURXJKW IRUZDUG IURP �����....................................................

38

00

���

3D\PHQW PDGH ZLWK H[WHQVLRQ� (See Instructions) .............................................................39

00

40.

$0(1'(' 5(78516 21/<

- Previous payments: (See instructions) .............................40

���

(DUO\ FKLOGKRRG SURJUDP� &HUWL¿FDWLRQ 1XPEHU�

00

41

(20% of federal credit; Attach federal Form 2441 and Form AR1000EC)

................................

00

42.

TOTAL PAYMENTS: (Add Lines 37 through 41) .........................................................................................................42

00

43.

$0(1'(' 5(78516 21/<

- Previous refund: (See instructions) .............................................................................. 43

00

���

$GMXVWHG 7RWDO 3D\PHQWV� (Subtract Line 43 from Line 42)..............................................................................................44

00

45.

AMOUNT OF OVERPAYMENT/REFUND: (If Line 44 is greater than Line 36D, enter difference) ......................... 45

���

$PRXQW WR EH DSSOLHG WR ���� HVWLPDWHG WD[� .....................................................................46

00

47.

Amount of Check-off Contributions:

(Attach Schedule AR1000-CO)

.................................47

00

-

00

48.

AMOUNT TO BE REFUNDED TO YOU: (Subtract Lines 46 and 47 from Line 45) ............................. REFUND 48

DIRECT DEPOSIT? ,I \RX ZDQW \RXU UHIXQG GLUHFW GHSRVLWHG \RX PXVW FKHFN WKLV ER[

and

complete Form ARDD and attach it to your return. (Direct deposit is not available for amended returns.)

/

00

49.

AMOUNT DUE: (If Line 44 is less than Line 36D, enter difference; If over $1,000, continue to 50A) ..... TAX DUE 49

00

50A.

UEP: $WWDFK )RUP $5���� RU $5����$� ,I UHTXLUHG� HQWHU H[FHSWLRQ LQ ER[

50A

Penalty 50B

50C.

$GG /LQHV �� DQG ��%� $WWDFK )RUP $5����9 ZLWK FKHFN RU PRQH\ RUGHU SD\DEOH LQ 8�6� 'ROODUV WR ³'HSW� RI )LQDQFH

00

and Administration”. ,QFOXGH \RXU 661 RQ SD\PHQW� 7R SD\ E\ FUHGLW FDUG� VHH LQVWUXFWLRQV

.............. TOTAL DUE 50C

51.

$PRXQW RI LQFRPH QRW VXEMHFW WR $UNDQVDV WD[ IURP $5�� 3DUW ,,,� (Memorandum only)

0D\ WKH $UNDQVDV 5HYHQXH $JHQF\ GLVFXVV

this return with the preparer shown below?

Yes

No

FOR MAILING ADDRESSES SEE PAGE 2 OF INSTRUCTIONS

PLEASE SIGN HERE:

Under penalties of perjury, I declare that I have examined this return and accompanying schedules

and statements, and to the best of my knowledge and belief, they are true, correct and complete. Declaration of preparer (other

than taxpayer) is based on all information of which preparer has any knowledge.

Occupation

Your Signature

Date

7HOHSKRQH�

SIGN HERE

Spouse’s Signature

Occupation

Date

$OWHUQDWH 7HOHSKRQH�

Paid Preparer’s Signature

ID Number/Social Security Number

For Department Use Only

A

Preparer’s Name

&LW\�6WDWH�=LS

Address

7HOHSKRQH 1XPEHU

3DJH 15� �5 ��������

Click Here to Print Document

1

1 2

2