Personal Financial Statement Form - Minnesota Department Of Revenue

ADVERTISEMENT

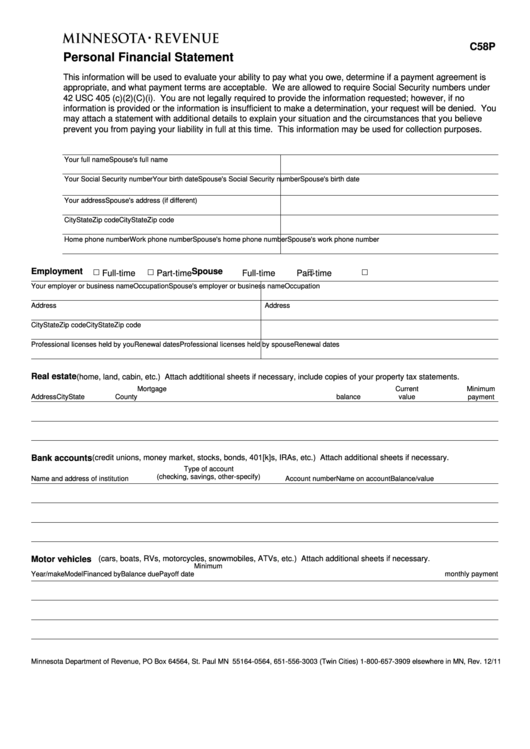

C58P

Personal Financial Statement

This information will be used to evaluate your ability to pay what you owe, determine if a payment agreement is

appropriate, and what payment terms are acceptable. We are allowed to require Social Security numbers under

42 USC 405 (c)(2)(C)(i). You are not legally required to provide the information requested; however, if no

information is provided or the information is insufficient to make a determination, your request will be denied. You

may attach a statement with additional details to explain your situation and the circumstances that you believe

prevent you from paying your liability in full at this time. This information may be used for collection purposes.

Your full name

Spouse's full name

Your Social Security number

Your birth date

Spouse's Social Security number

Spouse's birth date

Your address

Spouse's address (if different)

City

State

Zip code

City

State

Zip code

Home phone number

Work phone number

Spouse's home phone number

Spouse's work phone number

Employment

Spouse

Full-time

Part-time

Full-time

Part-time

Your employer or business name

Occupation

Spouse's employer or business name

Occupation

Address

Address

City

State

Zip code

City

State

Zip code

Professional licenses held by you

Renewal dates

Professional licenses held by spouse

Renewal dates

Real estate

(home, land, cabin, etc.) Attach addtitional sheets if necessary, include copies of your property tax statements.

Mortgage

Current

Minimum

Address

City

State

County

balance

value

payment

Bank accounts

(credit unions, money market, stocks, bonds, 401[k]s, IRAs, etc.) Attach additional sheets if necessary.

Type of account

(checking, savings, other-specify)

Name and address of institution

Account number

Name on account

Balance/value

Motor vehicles

(cars, boats, RVs, motorcycles, snowmobiles, ATVs, etc.) Attach additional sheets if necessary.

Minimum

Year/make

Model

Financed by

Balance due

Payoff date

monthly payment

Minnesota Department of Revenue, PO Box 64564, St. Paul MN 55164-0564, 651-556-3003 (Twin Cities) 1-800-657-3909 elsewhere in MN, Rev. 12/11

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2