Form T-205 - Consumer'S Use Tax Return

ADVERTISEMENT

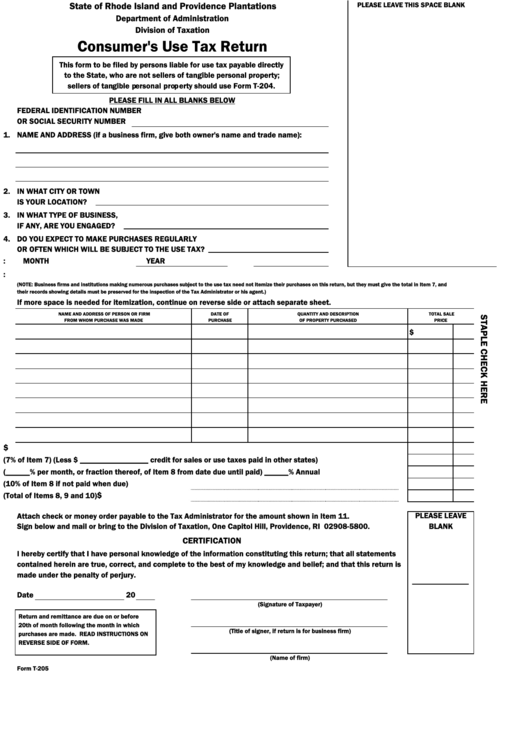

State of Rhode Island and Providence Plantations

PLEASE LEAVE THIS SPACE BLANK

Department of Administration

Division of Taxation

Consumer's Use Tax Return

This form to be filed by persons liable for use tax payable directly

to the State, who are not sellers of tangible personal property;

sellers of tangible personal property should use Form T-204.

PLEASE FILL IN ALL BLANKS BELOW

FEDERAL IDENTIFICATION NUMBER

OR SOCIAL SECURITY NUMBER

1.

NAME AND ADDRESS (if a business firm, give both owner's name and trade name):

2.

IN WHAT CITY OR TOWN

IS YOUR LOCATION?

3.

IN WHAT TYPE OF BUSINESS,

IF ANY, ARE YOU ENGAGED?

4.

DO YOU EXPECT TO MAKE PURCHASES REGULARLY

OR OFTEN WHICH WILL BE SUBJECT TO THE USE TAX?

5. THIS RETURN IS FOR:

MONTH

YEAR

6. SCHEDULE OF PURCHASES SUBJECT TO THE USE TAX:

(NOTE: Business firms and institutions making numerous purchases subject to the use tax need not itemize their purchases on this return, but they must give the total in Item 7, and

their records showing details must be preserved for the inspection of the Tax Administrator or his agent.)

If more space is needed for itemization, continue on reverse side or attach separate sheet.

NAME AND ADDRESS OF PERSON OR FIRM

DATE OF

QUANTITY AND DESCRIPTION

TOTAL SALE

FROM WHOM PURCHASE WAS MADE

PURCHASE

OF PROPERTY PURCHASED

PRICE

$

$

7. TOTAL SALE PRICE OF PURCHASES SUBJECT TO THE USE TAX

8. AMOUNT OF TAX (7% of Item 7) (Less $ _________________ credit for sales or use taxes paid in other states)

9. INTEREST (______% per month, or fraction thereof, of Item 8 from date due until paid) ______% Annual

10. PENALTY (10% of Item 8 if not paid when due)

$

11. TOTAL AMOUNT DUE (Total of Items 8, 9 and 10)

PLEASE LEAVE

Attach check or money order payable to the Tax Administrator for the amount shown in Item 11.

Sign below and mail or bring to the Division of Taxation, One Capitol Hill, Providence, RI 02908-5800.

BLANK

CERTIFICATION

I hereby certify that I have personal knowledge of the information constituting this return; that all statements

contained herein are true, correct, and complete to the best of my knowledge and belief; and that this return is

made under the penalty of perjury.

Date

20

(Signature of Taxpayer)

Return and remittance are due on or before

20th of month following the month in which

(Title of signer, if return is for business firm)

purchases are made. READ INSTRUCTIONS ON

REVERSE SIDE OF FORM.

(Name of firm)

Form T-205

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1