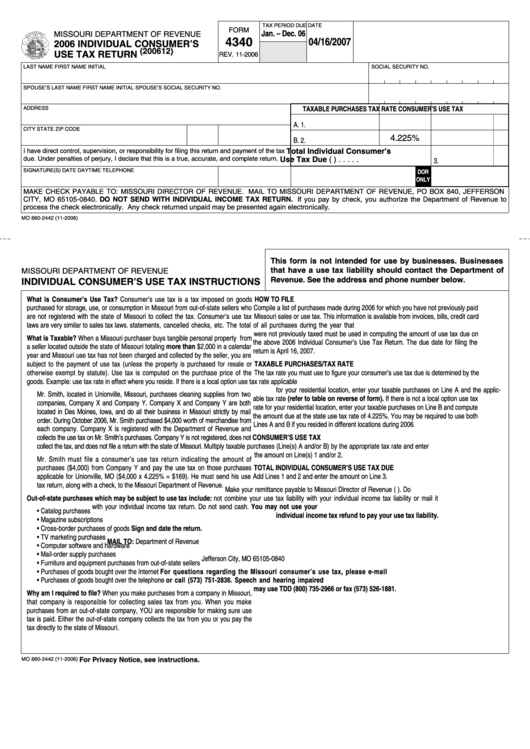

TAX PERIOD

DUE DATE

FORM

Jan. – Dec. 06

MISSOURI DEPARTMENT OF REVENUE

Reset Form

Print Form

4340

04/16/2007

2006 INDIVIDUAL CONSUMER’S

(200612)

USE TAX RETURN

REV. 11-2006

LAST NAME

FIRST NAME

INITIAL

SOCIAL SECURITY NO.

SPOUSE’S LAST NAME

FIRST NAME

INITIAL

SPOUSE’S SOCIAL SECURITY NO.

ADDRESS

TAXABLE PURCHASES

TAX RATE

CONSUMER’S USE TAX

A.

1.

CITY

STATE

ZIP CODE

4.225%

B.

2.

I have direct control, supervision, or responsibility for filing this return and payment of the tax

Total Individual Consumer’s

due. Under penalties of perjury, I declare that this is a true, accurate, and complete return.

Use Tax Due (U.S. funds only) . . . . .

3.

SIGNATURE(S)

DATE

DAYTIME TELEPHONE

DOR

ONLY

MAKE CHECK PAYABLE TO: MISSOURI DIRECTOR OF REVENUE. MAIL TO MISSOURI DEPARTMENT OF REVENUE, PO BOX 840, JEFFERSON

CITY, MO 65105-0840. DO NOT SEND WITH INDIVIDUAL INCOME TAX RETURN. If you pay by check, you authorize the Department of Revenue to

process the check electronically. Any check returned unpaid may be presented again electronically.

MO 860-2442 (11-2006)

This form is not intended for use by businesses. Businesses

that have a use tax liability should contact the Department of

MISSOURI DEPARTMENT OF REVENUE

Revenue. See the address and phone number below.

INDIVIDUAL CONSUMER’S USE TAX INSTRUCTIONS

What is Consumer’s Use Tax? Consumer’s use tax is a tax imposed on goods

HOW TO FILE

purchased for storage, use, or consumption in Missouri from out-of-state sellers who

Compile a list of purchases made during 2006 for which you have not previously paid

are not registered with the state of Missouri to collect the tax. Consumer’s use tax

Missouri sales or use tax. This information is available from invoices, bills, credit card

laws are very similar to sales tax laws.

statements, cancelled checks, etc. The total of all purchases during the year that

were not previously taxed must be used in computing the amount of use tax due on

What is Taxable? When a Missouri purchaser buys tangible personal property from

the above 2006 Individual Consumer’s Use Tax Return. The due date for filing the

a seller located outside the state of Missouri totaling more than $2,000 in a calendar

return is April 16, 2007.

year and Missouri use tax has not been charged and collected by the seller, you are

subject to the payment of use tax (unless the property is purchased for resale or

TAXABLE PURCHASES/TAX RATE

otherwise exempt by statute). Use tax is computed on the purchase price of the

The tax rate you must use to figure your consumer’s use tax due is determined by the

goods. Example:

use tax rate in effect where you reside. If there is a local option use tax rate applicable

for your residential location, enter your taxable purchases on Line A and the applic-

Mr. Smith, located in Unionville, Missouri, purchases cleaning supplies from two

able tax rate (refer to table on reverse of form). If there is not a local option use tax

companies, Company X and Company Y. Company X and Company Y are both

rate for your residential location, enter your taxable purchases on Line B and compute

located in Des Moines, Iowa, and do all their business in Missouri strictly by mail

the amount due at the state use tax rate of 4.225%. You may be required to use both

order. During October 2006, Mr. Smith purchased $4,000 worth of merchandise from

Lines A and B if you resided in different locations during 2006.

each company. Company X is registered with the Department of Revenue and

collects the use tax on Mr. Smith’s purchases. Company Y is not registered, does not

CONSUMER’S USE TAX

collect the tax, and does not file a return with the state of Missouri.

Multiply taxable purchases (Line(s) A and/or B) by the appropriate tax rate and enter

the amount on Line(s) 1 and/or 2.

Mr. Smith must file a consumer’s use tax return indicating the amount of

purchases ($4,000) from Company Y and pay the use tax on those purchases

TOTAL INDIVIDUAL CONSUMER’S USE TAX DUE

applicable for Unionville, MO ($4,000 x 4.225% = $169). He must send his use

Add Lines 1 and 2 and enter the amount on Line 3.

tax return, along with a check, to the Missouri Department of Revenue.

Make your remittance payable to Missouri Director of Revenue (U.S. funds only). Do

Out-of-state purchases which may be subject to use tax include:

not combine your use tax liability with your individual income tax liability or mail it

with your individual income tax return. Do not send cash. You may not use your

• Catalog purchases

individual income tax refund to pay your use tax liability.

• Magazine subscriptions

• Cross-border purchases of goods

Sign and date the return.

• TV marketing purchases

MAIL TO: Department of Revenue

• Computer software and hardware

P.O. Box 840

• Mail-order supply purchases

Jefferson City, MO 65105-0840

• Furniture and equipment purchases from out-of-state sellers

• Purchases of goods bought over the Internet

For questions regarding the Missouri consumer’s use tax, please e-mail

• Purchases of goods bought over the telephone

salesuse@dor.mo.gov or call (573) 751-2836. Speech and hearing impaired

may use TDD (800) 735-2966 or fax (573) 526-1881.

Why am I required to file? When you make purchases from a company in Missouri,

that company is responsible for collecting sales tax from you. When you make

purchases from an out-of-state company, YOU are responsible for making sure use

tax is paid. Either the out-of-state company collects the tax from you or you pay the

tax directly to the state of Missouri.

MO 860-2442 (11-2006)

For Privacy Notice, see instructions.

1

1