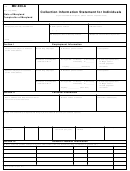

Step 4: Complete the following statement of assets and liabilities

A

B

C

D

E

F

G

Monthly

Date of

Date of

Amount of

Present

Liabilities

payment

first

final

equity or asset

Description

value

Balance due

amount

Pledgee or obligee

payment

payment

(Col. A minus B)

16

Bank accounts

_________

_________

_________

_________

__________________

________

________

17

_________

_________

_________

_________

__________________

________

________

Household furniture

18

_________

_________

_________

_________

__________________

________

________

Home mortgage

19

Rental properties

_________

_________

_________

_________

__________________

________

________

20

_________

_________

_________

_________

__________________

________

________

Real property

21

Vehicles (model/year)

a __________________

_________

_________

_________

_________

__________________

________

________

b __________________

_________

_________

_________

_________

__________________

________

________

22

Other assets (describe)

a __________________

_________

_________

_________

_________

__________________

________

________

b __________________

_________

_________

_________

_________

__________________

________

________

23

Federal taxes outstanding

_________

_________

_________

_________

__________________

________

________

24

_________

_________

_________

_________

__________________

________

________

State taxes outstanding

25

_________

_________

_________

_________

__________________

________

________

Accounts/notes payable

26

Charge cards

a __________________

_________

_________

_________

_________

__________________

________

________

b __________________

_________

_________

_________

_________

__________________

________

________

27

Other (include judgments)

a __________________

_________

_________

_________

_________

__________________

________

________

b __________________

_________

_________

_________

_________

__________________

________

________

28

_________

_________

_________

_________

Total

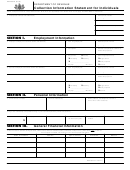

Step 5: Complete the following monthly income and expense analysis

Household monthly income

Monthly expenses

Source

Net

Expense

Amount

29

35

Your take home pay

___________________

Rent (if no home mortgage in Step 4) ___________________

30

36

Your spouse’s take home pay

___________________

Groceries

___________________

31

37

Pensions

___________________

Monthly payments (from Line 28)

___________________

32

38

Rental income

___________________

Utilities

___________________

33

39

Other (specify)

Auto expenses (i.e., insurance, gas)

___________________

40

________________

___________________

Child support paid

___________________

41

________________

___________________

Other (specify)

________________

___________________

___________________

___________________

________________

___________________

___________________

___________________

________________

___________________

___________________

___________________

34

42

Add Lines 29 through 33.

Add Lines 35 through 41.

This amount is your total net income.

____________________

This amount is your total expenses.

___________________

43

43

Subtract Line 42 from Line 34. This amount is your monthly net income after expenses.

___________________

Step 6: Sign below

Under penalties of perjury, I state that this statement of assets and liabilities and other information is, to the best of my knowledge, true, correct,

and complete.

Debtor’s signature______________________________________________________________ Date ___ ___/___ ___/___ ___ ___ ___

Spouse’s signature_____________________________________________________________ Date ___ ___/___ ___/___ ___ ___ ___

This form is authorized as outlined by the Illinois Income Tax Act and the Retailers’ Occupation and related occupation taxes and fees acts.

Disclosure of this information is REQUIRED. Failure to provide information could result in this form not being processed.

EG-13-I back (R-5/12)

Reset

Print

1

1 2

2