Form De 370 - Statement Of Amount Due From Worker

ADVERTISEMENT

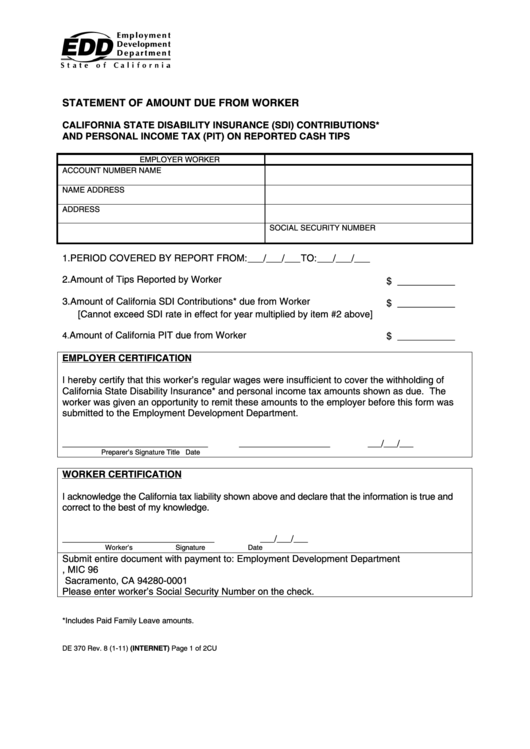

STATEMENT OF AMOUNT DUE FROM WORKER

CALIFORNIA STATE DISABILITY INSURANCE (SDI) CONTRIBUTIONS*

AND PERSONAL INCOME TAX (PIT) ON REPORTED CASH TIPS

EMPLOYER

WORKER

ACCOUNT NUMBER

NAME

NAME

ADDRESS

ADDRESS

SOCIAL SECURITY NUMBER

1. PERIOD COVERED BY REPORT

FROM: ___/___/___

TO: ___/___/___

2. Amount of Tips Reported by Worker

$ ___________

3. Amount of California SDI Contributions* due from Worker

$ ___________

[Cannot exceed SDI rate in effect for year multiplied by item #2 above]

Amount of California PIT due from Worker

$ ___________

4.

EMPLOYER CERTIFICATION

I hereby certify that this worker’s regular wages were insufficient to cover the withholding of

California State Disability Insurance* and personal income tax amounts shown as due. The

worker was given an opportunity to remit these amounts to the employer before this form was

submitted to the Employment Development Department.

________________________________ ____________________

___/___/___

Preparer’s Signature

Title

Date

WORKER CERTIFICATION

I acknowledge the California tax liability shown above and declare that the information is true and

correct to the best of my knowledge.

________________________________

___/___/___

Worker’s Signature

Date

Submit entire document with payment to: Employment Development Department

P.O. Box 826880, MIC 96

Sacramento, CA 94280-0001

Please enter worker’s Social Security Number on the check.

*Includes Paid Family Leave amounts.

DE 370 Rev. 8 (1-11) (INTERNET)

Page 1 of 2

CU

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1