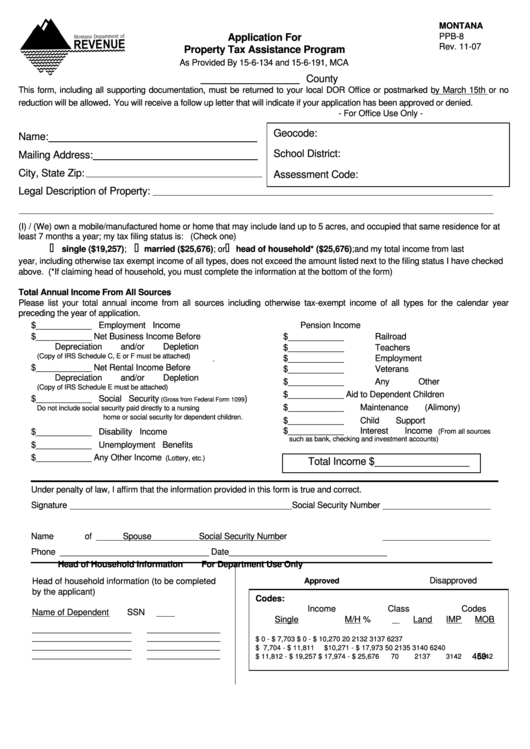

Ppb-8 - Application For Property Tax Assistance Program Form Montana

ADVERTISEMENT

MONTANA

PPB-8

Application For

Rev. 11-07

Property Tax Assistance Program

As Provided By 15-6-134 and 15-6-191, MCA

County

This form, including all supporting documentation, must be returned to your local DOR Office or postmarked by March 15th or no

.

reduction will be allowed

You will receive a follow up letter that will indicate if your application has been approved or denied.

- For Office Use Only -

Geocode:

Name:

School District:

Mailing Address:

City, State Zip:

Assessment Code:

Legal Description of Property:

(I) / (We) own a mobile/manufactured home or home that may include land up to 5 acres, and occupied that same residence for at

least 7 months a year; my tax filing status is: (Check one)

single ($19,257);

married ($25,676); or

head of household* ($25,676); and my total income from last

year, including otherwise tax exempt income of all types, does not exceed the amount listed next to the filing status I have checked

above. (*If claiming head of household, you must complete the information at the bottom of the form)

Total Annual Income From All Sources

Please list your total annual income from all sources including otherwise tax-exempt income of all types for the calendar year

preceding the year of application.

$____________ Employment Income

Pension Income

$____________ Net Business Income Before

$____________

Railroad

Depreciation and/or Depletion

$____________

Teachers

(Copy of IRS Schedule C, E or F must be attached)

$____________

Employment

$____________ Net Rental Income Before

$____________

Veterans

Depreciation and/or Depletion

$____________

Any Other

(Copy of IRS Schedule E must be attached)

$____________

Aid to Dependent Children

$____________ Social Security

)

(Gross from Federal Form 1099

$____________

Maintenance (Alimony)

Do not include social security paid directly to a nursing

home or social security for dependent children.

$____________

Child Support

$____________

Interest Income

$____________ Disability Income

(From all sources

such as bank, checking and investment accounts)

$____________ Unemployment Benefits

$____________ Any Other Income

(Lottery, etc.)

Total Income $_________________

Under penalty of law, I affirm that the information provided in this form is true and correct.

Signature

Social Security Number

Name of Spouse

Social Security Number

Phone ________________________________ Date__________________________________

Head of Household Information

For Department Use Only

Disapproved

Head of household information (to be completed

Approved

by the applicant)

Codes:

Income

Class Codes

Name of Dependent

SSN

Single

M/H

%

Land

IMP

MOB

___________________

______________

___________________

______________

$

0 - $ 7,703

$

0 - $ 10,270

20

2132

3137

6237

___________________

______________

$ 7,704 - $ 11,811

$10,271 - $ 17,973

50

2135

3140

6240

___________________

______________

459

$ 11,812 - $ 19,257

$ 17,974 - $ 25,676

70

2137

3142

6242

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1