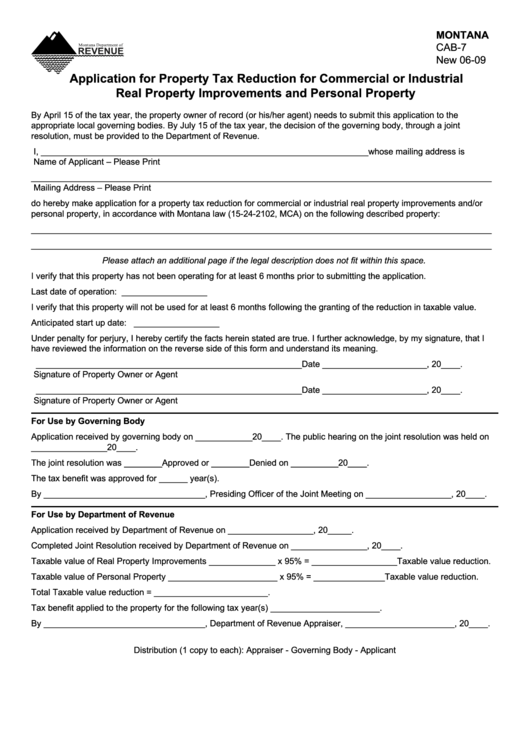

Form Cab-7 - Application For Property Tax Reduction For Commercial Or Industrial Real Property Improvements And Personal Property

ADVERTISEMENT

MONTANA

CAB-7

New 06-09

Application for Property Tax Reduction for Commercial or Industrial

Real Property Improvements and Personal Property

By April 15 of the tax year, the property owner of record (or his/her agent) needs to submit this application to the

appropriate local governing bodies. By July 15 of the tax year, the decision of the governing body, through a joint

resolution, must be provided to the Department of Revenue.

I, _____________________________________________________________________whose mailing address is

Name of Applicant – Please Print

_________________________________________________________________________________________________

Mailing Address – Please Print

do hereby make application for a property tax reduction for commercial or industrial real property improvements and/or

personal property, in accordance with Montana law (15-24-2102, MCA) on the following described property:

_________________________________________________________________________________________________

_________________________________________________________________________________________________

Please attach an additional page if the legal description does not fit within this space.

I verify that this property has not been operating for at least 6 months prior to submitting the application.

Last date of operation:

__________________

I verify that this property will not be used for at least 6 months following the granting of the reduction in taxable value.

Anticipated start up date:

__________________

Under penalty for perjury, I hereby certify the facts herein stated are true. I further acknowledge, by my signature, that I

have reviewed the information on the reverse side of this form and understand its meaning.

________________________________________________________Date ______________________, 20____ .

Signature of Property Owner or Agent

________________________________________________________Date ______________________, 20____ .

Signature of Property Owner or Agent

For Use by Governing Body

Application received by governing body on ____________20____. The public hearing on the joint resolution was held on

________________20____.

The joint resolution was ________Approved or ________Denied on __________20____.

The tax benefit was approved for ______ year(s).

By __________________________________ , Presiding Officer of the Joint Meeting on __________________, 20____ .

For Use by Department of Revenue

Application received by Department of Revenue on __________________, 20_____.

Completed Joint Resolution received by Department of Revenue on ________________, 20____.

Taxable value of Real Property Improvements ______________ x 95% = __________________Taxable value reduction.

Taxable value of Personal Property _______________________ x 95% = _______________Taxable value reduction.

Total Taxable value reduction = ________________________.

Tax benefit applied to the property for the following tax year(s) _______________________.

By __________________________________ , Department of Revenue Appraiser, _______________________, 20____ .

Distribution (1 copy to each): Appraiser - Governing Body - Applicant

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2