Rpd-41330 - Application For Alternative Energy Product Manufacturers Tax Credit Form New Mexico

ADVERTISEMENT

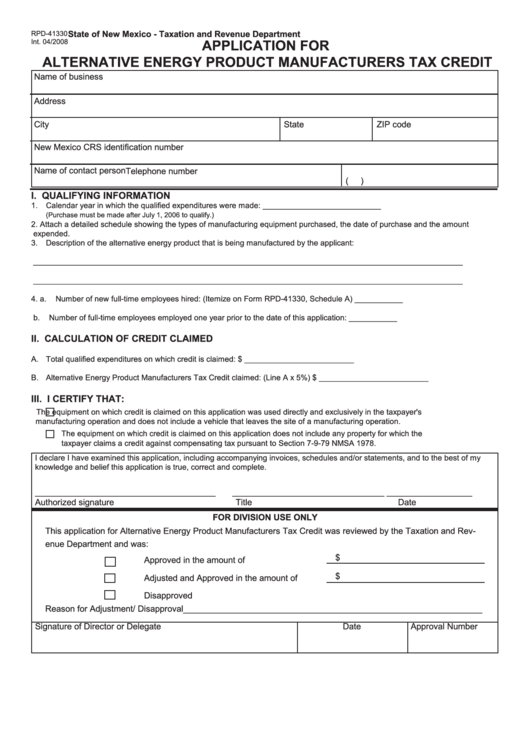

State of New Mexico - Taxation and Revenue Department

RPD-41330

APPLICATION FOR

Int. 04/2008

ALTERNATIVE ENERGY PRODUCT MANUFACTURERS TAX CREDIT

Name of business

Address

City

State

ZIP code

New Mexico CRS identification number

Name of contact person

Telephone number

(

)

I. QUALIFYING INFORMATION

1. Calendar year in which the qualified expenditures were made: ___________________________

(Purchase must be made after July 1, 2006 to qualify.)

2.

Attach a detailed schedule showing the types of manufacturing equipment purchased, the date of purchase and the amount

expended.

3. Description of the alternative energy product that is being manufactured by the applicant:

__________________________________________________________________________________________________

__________________________________________________________________________________________________

4. a. Number of new full-time employees hired: (Itemize on Form RPD-41330, Schedule A)

___________

b. Number of full-time employees employed one year prior to the date of this application:

___________

II. CALCULATION OF CREDIT CLAIMED

A. Total qualified expenditures on which credit is claimed:

$ _________________________

B. Alternative Energy Product Manufacturers Tax Credit claimed: (Line A x 5%)

$ _________________________

III. I CERTIFY THAT:

The equipment on which credit is claimed on this application was used directly and exclusively in the taxpayer's

manufacturing operation and does not include a vehicle that leaves the site of a manufacturing operation.

The equipment on which credit is claimed on this application does not include any property for which the

taxpayer claims a credit against compensating tax pursuant to Section 7-9-79 NMSA 1978.

I declare I have examined this application, including accompanying invoices, schedules and/or statements, and to the best of my

knowledge and belief this application is true, correct and complete.

______________________________________

________________________________

__________________

Authorized signature

Title

Date

FOR DIVISION USE ONLY

This application for Alternative Energy Product Manufacturers Tax Credit was reviewed by the Taxation and Rev-

enue Department and was:

$

Approved in the amount of

$

Adjusted and Approved in the amount of

Disapproved

Reason for Adjustment/ Disapproval_______________________________________________________________

Approval Number

Signature of Director or Delegate

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2