Form 51a290 - Information Sharing And Assignment Agreement For Designated Refund Claims - Commonwealth Of Kentucky - Department Of Revenue

ADVERTISEMENT

Page 1

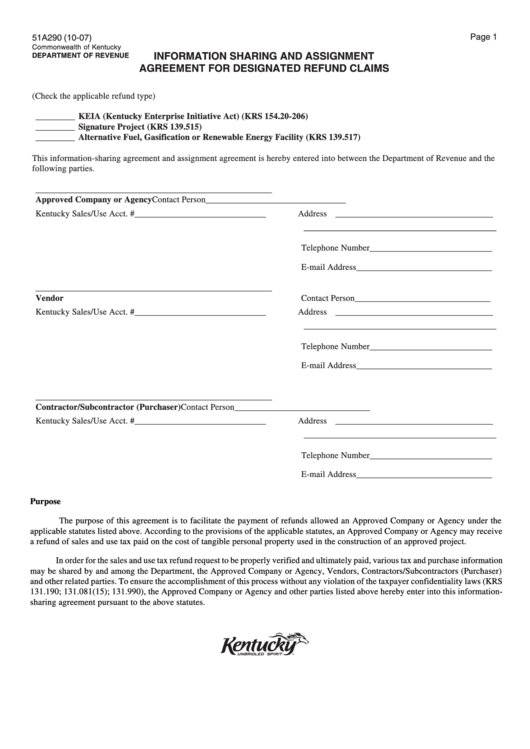

51A290 (10-07)

Commonwealth of Kentucky

INFORMATION SHARING AND ASSIGNMENT

DEPARTMENT OF REVENUE

AGREEMENT FOR DESIGNATED REFUND CLAIMS

(Check the applicable refund type)

_________ KEIA (Kentucky Enterprise Initiative Act) (KRS 154.20-206)

_________ Signature Project (KRS 139.515)

_________ Alternative Fuel, Gasification or Renewable Energy Facility (KRS 139.517)

This information-sharing agreement and assignment agreement is hereby entered into between the Department of Revenue and the

following parties.

______________________________________________________

Approved Company or Agency

Contact Person ________________________________

Kentucky Sales/Use Acct. # ______________________________

Address ____________________________________

____________________________________________

Telephone Number ____________________________

E-mail Address _______________________________

______________________________________________________

Vendor

Contact Person _______________________________

Kentucky Sales/Use Acct. # ______________________________

Address ____________________________________

____________________________________________

Telephone Number ____________________________

E-mail Address _______________________________

______________________________________________________

Contractor/Subcontractor (Purchaser)

Contact Person _______________________________

Kentucky Sales/Use Acct. # ______________________________

Address ____________________________________

____________________________________________

Telephone Number ____________________________

E-mail Address _______________________________

Purpose

The purpose of this agreement is to facilitate the payment of refunds allowed an Approved Company or Agency under the

applicable statutes listed above. According to the provisions of the applicable statutes, an Approved Company or Agency may receive

a refund of sales and use tax paid on the cost of tangible personal property used in the construction of an approved project.

In order for the sales and use tax refund request to be properly verified and ultimately paid, various tax and purchase information

may be shared by and among the Department, the Approved Company or Agency, Vendors, Contractors/Subcontractors (Purchaser)

and other related parties. To ensure the accomplishment of this process without any violation of the taxpayer confidentiality laws (KRS

131.190; 131.081(15); 131.990), the Approved Company or Agency and other parties listed above hereby enter into this information-

sharing agreement pursuant to the above statutes.

An Equal Opportunity Employer M/F/D

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3