Ar1036 Tuition Reimbursement Tax Credit Program Form

ADVERTISEMENT

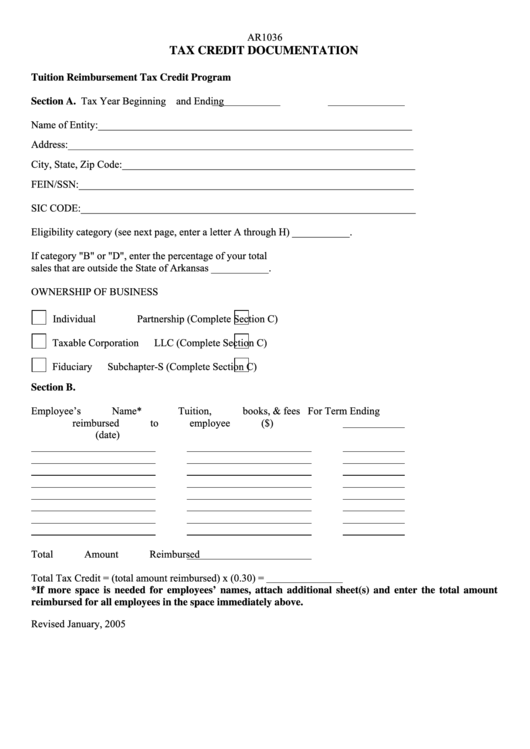

AR1036

TAX CREDIT DOCUMENTATION

Tuition Reimbursement Tax Credit Program

Tax Year Beginning

and Ending

Section A.

Name of Entity:____________________________________________________________

Address:__________________________________________________________________

City, State, Zip Code:________________________________________________________

FEIN/SSN:________________________________________________________________

SIC CODE:________________________________________________________________

Eligibility category (see next page, enter a letter A through H) ___________.

If category "B" or "D", enter the percentage of your total

sales that are outside the State of Arkansas

___________.

OWNERSHIP OF BUSINESS

Individual

Partnership (Complete Section C)

Taxable Corporation

LLC (Complete Section C)

Fiduciary

Subchapter-S (Complete Section C)

Section B.

Employee’s Name*

Tuition, books, & fees

For Term Ending

reimbursed to employee ($)

(date)

Total Amount Reimbursed

Total Tax Credit = (total amount reimbursed) x (0.30) =

*If more space is needed for employees’ names, attach additional sheet(s) and enter the total amount

reimbursed for all employees in the space immediately above.

Revised January, 2005

20

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2