CLICK HERE TO CLEAR FORM

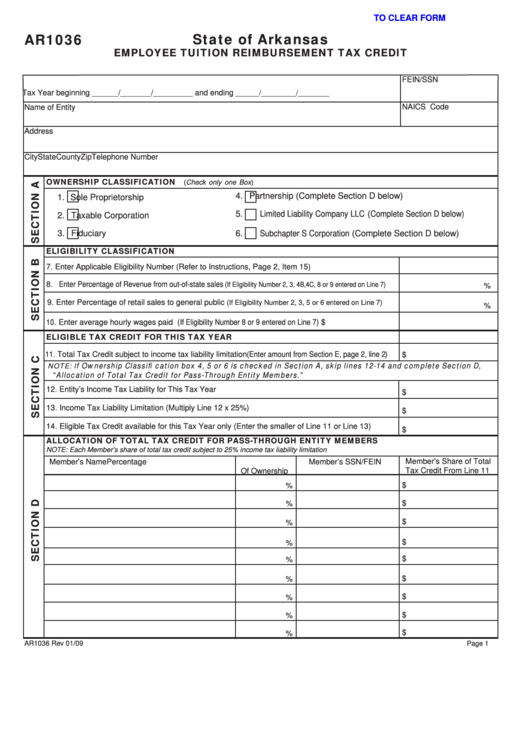

State of Arkansas

AR1036

EMPLOYEE TUITION REIMBURSEMENT TAX CREDIT

FEIN/SSN

Tax Year beginning ______ /_______/_________ and ending

______/_________/________

Name of Entity

NAICS Code

Address

City

State

County

Zip

Telephone Number

OWNERSHIP CLASSIFICATION

(Check only one Box)

4.

Partnership (Complete Section D below)

1.

Sole Proprietorship

5.

Limited Liability Company LLC (Complete Section D below)

2.

Taxable Corporation

3.

Fiduciary

6.

Subchapter S Corporation (Complete Section D below)

ELIGIBILITY CLASSIFICATION

7. Enter Applicable Eligibility Number (Refer to Instructions, Page 2, Item 15)

8. Enter Percentage of Revenue from out-of-state sales

(If Eligibility Number 2, 3, 4B,4C, 8 or 9 entered on Line 7)

%

9. Enter Percentage of retail sales to general public

(If Eligibility Number 2, 3, 5 or 6 entered on Line 7)

%

10. Enter average hourly wages paid (If Eligibility Number 8 or 9 entered on Line 7)

$

ELIGIBLE TAX CREDIT FOR THIS TAX YEAR

11. Total Tax Credit subject to income tax liability limitation (Enter amount from Section E, page 2, line 2)

$

f Ownership Classifi cation box 4, 5 or 6 is checked in Section A, skip lines 12-14 and complete Section D,

NOTE: I

“Allocation of Total Tax Credit for Pass-Through Entity Members.”

12. Entity’s Income Tax Liability for This Tax Year

$

13. Income Tax Liability Limitation (Multiply Line 12 x 25%)

$

14. Eligible Tax Credit available for this Tax Year only (Enter the smaller of Line 11 or Line 13)

$

ALLOCATION OF TOTAL TAX CREDIT FOR PASS-THROUGH ENTITY MEMBERS

NOTE: Each Member’s share of total tax credit subject to 25% income tax liability limitation

Member’s Share of Total

Member’s Name

Percentage

Member’s SSN/FEIN

Tax Credit From Line 11

Of Ownership

$

%

$

%

$

%

$

%

$

%

$

%

$

%

$

%

$

%

AR1036 Rev 01/09

Page 1

1

1 2

2