Employee Tuition Reimbursement Tax Credit Instructions For Form Ar1036

ADVERTISEMENT

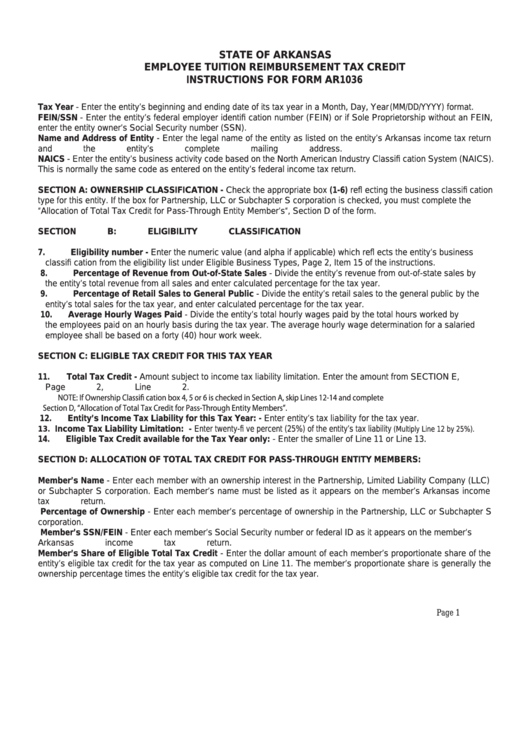

STATE OF ARKANSAS

EMPLOYEE TUITION REIMBURSEMENT TAX CREDIT

INSTRUCTIONS FOR FORM AR1036

Tax Year - Enter the entity’s beginning and ending date of its tax year in a Month, Day, Year (MM/DD/YYYY) format.

FEIN/SSN - Enter the entity’s federal employer identifi cation number (FEIN) or if Sole Proprietorship without an FEIN,

enter the entity owner’s Social Security number (SSN).

Name and Address of Entity - Enter the legal name of the entity as listed on the entity’s Arkansas income tax return

and the entity’s complete mailing address.

NAICS - Enter the entity’s business activity code based on the North American Industry Classifi cation System (NAICS).

This is normally the same code as entered on the entity’s federal income tax return.

SECTION A: OWNERSHIP CLASSIFICATION - Check the appropriate box (1-6) refl ecting the business classifi cation

type for this entity. If the box for Partnership, LLC or Subchapter S corporation is checked, you must complete the

“Allocation of Total Tax Credit for Pass-Through Entity Member’s“, Section D of the form.

SECTION B: ELIGIBILITY CLASSIFICATION

7.

Eligibility number - Enter the numeric value (and alpha if applicable) which refl ects the entity’s business

classifi cation from the eligibility list under Eligible Business Types, Page 2, Item 15 of the instructions.

8.

Percentage of Revenue from Out-of-State Sales - Divide the entity’s revenue from out-of-state sales by

the entity’s total revenue from all sales and enter calculated percentage for the tax year.

9.

Percentage of Retail Sales to General Public - Divide the entity’s retail sales to the general public by the

entity’s total sales for the tax year, and enter calculated percentage for the tax year.

10. Average Hourly Wages Paid - Divide the entity’s total hourly wages paid by the total hours worked by

the employees paid on an hourly basis during the tax year. The average hourly wage determination for a salaried

employee shall be based on a forty (40) hour work week.

SECTION C: ELIGIBLE TAX CREDIT FOR THIS TAX YEAR

11. Total Tax Credit - Amount subject to income tax liability limitation. Enter the amount from SECTION E,

Page 2, Line 2.

NOTE: If Ownership Classifi cation box 4, 5 or 6 is checked in Section A, skip Lines 12-14 and complete

Section D, “Allocation of Total Tax Credit for Pass-Through Entity Members”.

12. Entity’s Income Tax Liability for this Tax Year: - Enter entity’s tax liability for the tax year.

Income Tax Liability Limitation:

Enter twenty-fi ve percent (25%) of the entity’s tax liability

13.

-

(Multiply Line 12 by 25%).

14. Eligible Tax Credit available for the Tax Year only: - Enter the smaller of Line 11 or Line 13.

SECTION D: ALLOCATION OF TOTAL TAX CREDIT FOR PASS-THROUGH ENTITY MEMBERS:

Member’s Name - Enter each member with an ownership interest in the Partnership, Limited Liability Company (LLC)

or Subchapter S corporation. Each member’s name must be listed as it appears on the member’s Arkansas income

tax return.

Percentage of Ownership - Enter each member’s percentage of ownership in the Partnership, LLC or Subchapter S

corporation.

Member’s SSN/FEIN - Enter each member’s Social Security number or federal ID as it appears on the member’s

Arkansas income tax return.

Member’s Share of Eligible Total Tax Credit - Enter the dollar amount of each member’s proportionate share of the

entity’s eligible tax credit for the tax year as computed on Line 11. The member’s proportionate share is generally the

ownership percentage times the entity’s eligible tax credit for the tax year.

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2