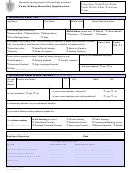

Massachusetts Department Of Transitional Assistance Food Stamp Benefits Application Page 2

ADVERTISEMENT

To apply for food stamp benefits, you need to prove your income, expenses and other information. You

only need to prove information that applies to you. For example, if you do not pay for child care, then

you do not need to worry about number 8 on the list below.

After your interview, you will get a list of things you will need to show us. Pay stubs, utility bills and other

papers must not be more than four weeks old from the day that you turn in the Food Stamp Benefits

Application.

Things you need to provide, if they apply to you:

1. Proof of Identity: Driver’s license, birth certificate or other proof of your identity.

2. Proof of Residence: If you own your home, proof of your mortgage, taxes and

insurance. If you rent, a rent receipt or lease agreement or other proof of where you live.

3. Utility Bills: Gas, electric and telephone bills.

4. Non-citizen Status: For all non-US citizens applying for food stamp benefits, alien

registration card or proof that INS knows you are living in the U.S.

5. Bank Accounts: Most recent checking account statement, updated savings passbook,

credit union records, stocks, bonds, CD’s or IRA and Keogh accounts. (Not required if

you are a family with children under 19 or everyone you are applying for is on SSI or

EAEDC.)

6. Earned Income: Pay stubs or written statement from employer showing income before

taxes for the past four weeks.

7. Self-Employment: Most recent federal tax return (Schedule C Form) or last three

months of business records.

8. Child Care or Adult Dependent Care Expenses: Written statement from your care

provider, or a canceled check or money order paid to the care provider.

9. Unearned Income: Most recent copy of Social Security check or copy of award letter;

proof of unemployment, workers’ compensation, pension, child support, alimony.

10. Rental Income: If you get paid by someone who rents a room or apartment from you,

a copy of the lease agreement, or statement from your tenant showing amount of rent paid.

Also your mortgage, tax bill, home owner’s insurance, water and sewerage bills.

11. Medical Expenses: If you or anyone in your household is age 60 or older or has a

certified disability, we can deduct certain medical expenses you pay from your

countable income. This includes co-payments or premiums on health insurance,

dentures, eyeglasses, hearing aid batteries, prescription medications, doctor-prescribed

pain relievers, vitamins and other over-the-counter drugs, and transportation that you

pay for to get to medical services.

12. Child Support Payments: If you make child support payments to someone not living with you,

proof of the legal obligation to make the payment and the amount paid.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8