Select to Reset Form

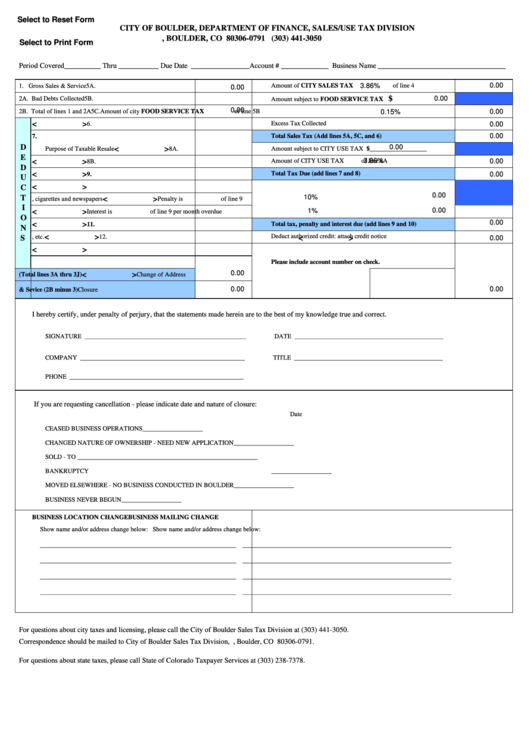

CITY OF BOULDER, DEPARTMENT OF FINANCE, SALES/USE TAX DIVISION

P.O. BOX 791, BOULDER, CO 80306-0791 (303) 441-3050

Select to Print Form

Period Covered__________ Thru ___________ Due Date ________________

Account # _____________ Business Name ___________________________________

0.00

Amount of CITY SALES TAX

3.86%

of line 4

1.

Gross Sales & Service

5A.

0.00

$

0.00

2A. Bad Debts Collected

5B.

Amount subject to FOOD SERVICE TAX

0.00

2B. Total of lines 1 and 2A

5C. Amount of city FOOD SERVICE TAX

0.15%

of line 5B

0.00

<

>

Excess Tax Collected

3A. Non-taxable Service and Sales

6.

0.00

0.00

3B. Sales to Other Licensed Dealers for

7.

Total Sales Tax (Add lines 5A, 5C, and 6)

D

0.00

<

>

Amount subject to CITY USE TAX $__________________

Purpose of Taxable Resale

8A.

E

3.86%

<

>

Amount of CITY USE TAX

of line 8A

0.00

3C. Sales shipped out of city and/or state

8B.

D

<

>

3D. Bad debts charged off

9.

Total Tax Due (add lines 7 and 8)

0.00

U

<

>

3E. Trade Ins for taxable resale

10. If return is filed after

then add penalty and interest

C

0.00

T

10%

<

>

3F. Sales of gasoline, cigarettes and newspapers

Penalty is

of line 9

I

1%

0.00

<

>

3G. Sales to governmental and religious orgs

Interest is

of line 9 per month overdue

O

0.00

<

>

3H. Returned Goods

11.

Total tax, penalty and interest due (add lines 9 and 10)

N

<

>

Deduct authorized credit: attach credit notice

3I. Prescriptions, etc.

12.

S

<

>

0.00

<

>

3J. Sales below tax minimum

13. Total Due and Payable to City of Boulder

Please include account number on check.

0.00

<

>

3.

Total Deductions (Total lines 3A thru 3J)

Change of Address

0.00

0.00

4.

Total City Net Taxable Sales & Sevice (2B minus 3)

Closure

I hereby certify, under penalty of perjury, that the statements made herein are to the best of my knowledge true and correct.

SIGNATURE ___________________________________________________

DATE _______________________________________________

COMPANY ____________________________________________________

TITLE _______________________________________________

PHONE _______________________________________________________

If you are requesting cancellation - please indicate date and nature of closure:

Date

CEASED BUSINESS OPERATIONS

___________________

CHANGED NATURE OF OWNERSHIP - NEED NEW APPLICATION

___________________

SOLD - TO ______________________________________

___________________

BANKRUPTCY

___________________

MOVED ELSEWHERE - NO BUSINESS CONDUCTED IN BOULDER

___________________

BUSINESS NEVER BEGUN

___________________

BUSINESS LOCATION CHANGE

BUSINESS MAILING CHANGE

Show name and/or address change below:

Show name and/or address change below:

______________________________________________________________

__________________________________________________________________

______________________________________________________________

__________________________________________________________________

______________________________________________________________

__________________________________________________________________

______________________________________________________________

__________________________________________________________________

For questions about city taxes and licensing, please call the City of Boulder Sales Tax Division at (303) 441-3050.

Correspondence should be mailed to City of Boulder Sales Tax Division, P.O. Box 791, Boulder, CO 80306-0791.

For questions about state taxes, please call State of Colorado Taxpayer Services at (303) 238-7378.

1

1 2

2