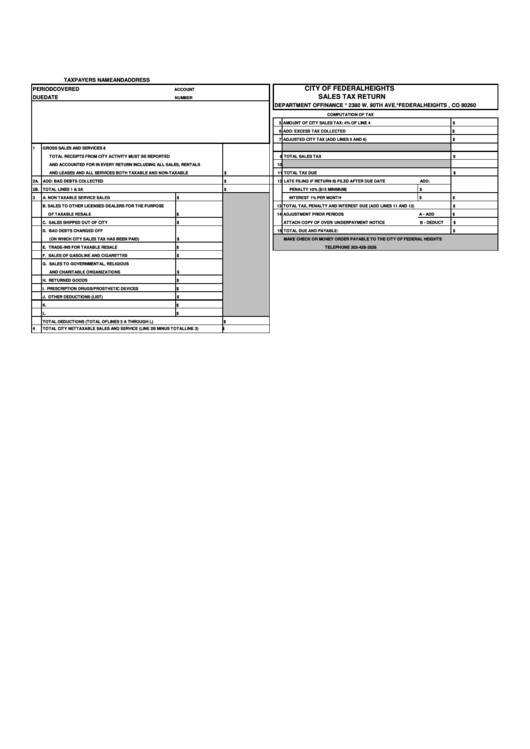

Sales Tax Return Form - City Of Federal Heights - Department Of Finance

ADVERTISEMENT

TAXPAYERS NAME AND ADDRESS

CITY OF FEDERAL HEIGHTS

PERIOD COVERED

ACCOUNT

SALES TAX RETURN

DUE DATE

NUMBER

DEPARTMENT OF FINANCE * 2380 W. 90TH AVE.*FEDERAL HEIGHTS , CO 80260

COMPUTATION OF TAX

5 AMOUNT OF CITY SALES TAX: 4% OF LINE 4

$

6 ADD: EXCESS TAX COLLECTED

$

7 ADJUSTED CITY TAX (ADD LINES 5 AND 6)

$

1

GROSS SALES AND SERVICES

8

TOTAL RECEIPTS FROM CITY ACTIVITY MUST BE REPORTED

9 TOTAL SALES TAX

$

AND ACCOUNTED FOR IN EVERY RETURN INCLUDING ALL SALES, RENTALS

10

AND LEASES AND ALL SERVICES BOTH TAXABLE AND NON-TAXABLE

$

11 TOTAL TAX DUE

$

2A. ADD: BAD DEBTS COLLECTED

$

12 LATE FILING IF RETURN IS FILED AFTER DUE DATE

ADD:

2B. TOTAL LINES 1 & 2A

$

PENALTY 10% ($15 MINIMUM)

$

3

A. NON TAXABLE SERVICE SALES

$

INTEREST 1% PER MONTH

$

$

B. SALES TO OTHER LICENSED DEALERS FOR THE PURPOSE

13 TOTAL TAX, PENALTY AND INTEREST DUE (ADD LINES 11 AND 12)

$

OF TAXABLE RESALE

$

14 ADJUSTMENT PRIOR PERIODS

A - ADD

$

C. SALES SHIPPED OUT OF CITY

$

ATTACH COPY OF OVER/ UNDERPAYMENT NOTICE

B - DEDUCT

$

D. BAD DEBTS CHARGED OFF

15 TOTAL DUE AND PAYABLE:

$

(ON WHICH CITY SALES TAX HAS BEEN PAID)

$

MAKE CHECK OR MONEY ORDER PAYABLE TO THE CITY OF FEDERAL HEIGHTS

E. TRADE-INS FOR TAXABLE RESALE

$

TELEPHONE 303-428-3526

F. SALES OF GASOLINE AND CIGARETTES

$

G. SALES TO GOVERNMENTAL, RELIGIOUS

AND CHARITABLE ORGANIZATIONS

$

H. RETURNED GOODS

$

I. PRESCRIPTION DRUGS/PROSTHETIC DEVICES

$

J. OTHER DEDUCTIONS (LIST)

$

K.

$

L.

$

TOTAL DEDUCTIONS (TOTAL OF LINES 3 A THROUGH L)

$

4

TOTAL CITY NET TAXABLE SALES AND SERVICE (LINE 2B MINUS TOTAL LINE 3)

$

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2