Sales Tax Return Form - City Of Loveland

ADVERTISEMENT

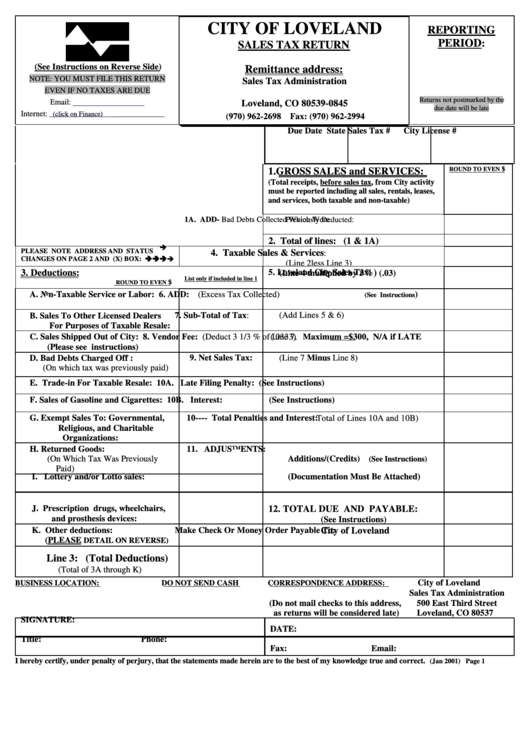

CITY OF LOVELAND

REPORTING

PERIOD

:

SALES TAX RETURN

(See Instructions on Reverse Side)

Remittance address:

NOTE: YOU MUST FILE THIS RETURN

Sales Tax Administration

EVEN IF NO TAXES ARE DUE

P.O. Box 0845

Returns not postmarked by the

Email:

Tax@ci.loveland.co.us

Loveland, CO 80539-0845

due date will be late

Internet:

(click on Finance)

(970) 962-2698 Fax: (970) 962-2994

Due Date

State Sales Tax #

City License #

$

ROUND TO EVEN

1. GROSS SALES and SERVICES:

(Total receipts, before sales tax, from City activity

must be reported including all sales, rentals, leases,

and services, both taxable and non-taxable)

1A. ADD- Bad Debts Collected Which Were

Previously Deducted:

2. Total of lines: (1 & 1A)

PLEASE NOTE ADDRESS AND STATUS

4. Taxable Sales & Services

:

CHANGES ON PAGE 2 AND (X) BOX: è

è è

è è

è è

è è

è è

è

(Line 2 less Line 3)

5. Loveland City Sales Tax:

3. Deductions:

List only if included in line 1

3%)

$

(Line 4 multiplied by

(.03)

ROUND TO EVEN

A. Non-Taxable Service or Labor:

6. ADD: (Excess Tax Collected)

)

(See Instructions

B. Sales To Other Licensed Dealers

7. Sub-Total of Tax:

For Purposes of Taxable Resale:

(Add Lines 5 & 6)

C. Sales Shipped Out of City:

8. Vendor Fee: (Deduct 3 1/3 % of Line 7,

(Please see instructions)

(.0333) Maximum =$300, N/A if LATE

D. Bad Debts Charged Off :

9. Net Sales Tax:

(On which tax was previously paid)

(Line 7 Minus Line 8)

E. Trade-in For Taxable Resale:

10A. Late Filing Penalty: (See Instructions)

F. Sales of Gasoline and Cigarettes:

10B. Interest:

(See Instructions)

G. Exempt Sales To: Governmental,

10---- Total Penalties and Interest:

Religious, and Charitable

Total of Lines 10A and 10B)

Organizations:

H. Returned Goods:

11. ADJUSTMENTS:

(On Which Tax Was Previously

Additions/(Credits)

(See Instructions)

Paid)

I. Lottery and/or Lotto sales:

(Documentation Must Be Attached)

J. Prescription drugs, wheelchairs,

12. TOTAL DUE AND PAYABLE:

and prosthesis devices:

(See Instructions)

K. Other deductions:

Make Check Or Money Order Payable To:

(PLEASE

DETAIL ON REVERSE)

City of Loveland

Line 3: (Total Deductions)

(Total of 3A through K)

City of Loveland

BUSINESS LOCATION:

DO NOT SEND CASH

CORRESPONDENCE ADDRESS:

Sales Tax Administration

(Do not mail checks to this address,

500 East Third Street

as returns will be considered late)

Loveland, CO 80537

SIGNATURE:

DATE:

Title:

Phone:

Fax:

Email:

I hereby certify, under penalty of perjury, that the statements made herein are to the best of my knowledge true and correct.

(Jan 2001) Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1