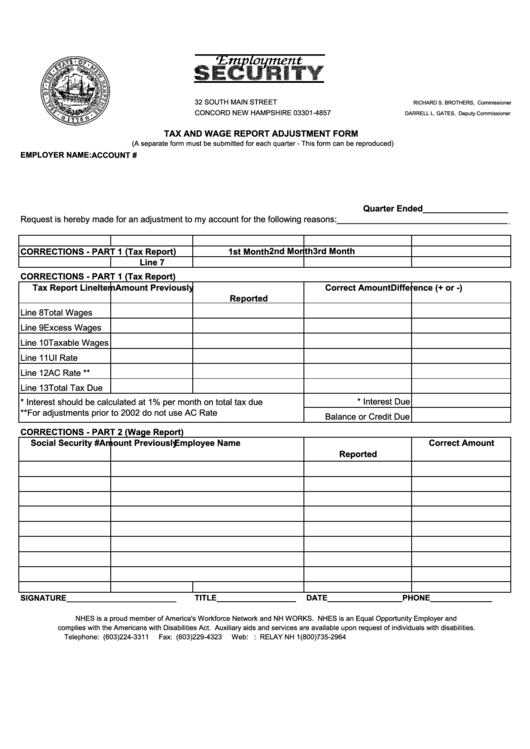

Tax And Wage Report Adjustment Form - New Hampshire

ADVERTISEMENT

32 SOUTH MAIN STREET

RICHARD S. BROTHERS, Commissioner

CONCORD NEW HAMPSHIRE 03301-4857

DARRELL L. GATES, Deputy Commissioner

TAX AND WAGE REPORT ADJUSTMENT FORM

(A separate form must be submitted for each quarter - This form can be reproduced)

EMPLOYER NAME:

ACCOUNT #

Quarter Ended__________________

Request is hereby made for an adjustment to my account for the following reasons:_____________________________________

2nd Month

3rd Month

CORRECTIONS - PART 1 (Tax Report)

1st Month

Line 7

CORRECTIONS - PART 1 (Tax Report)

Tax Report Line

Item

Amount Previously

Correct Amount

Difference (+ or -)

Reported

Line 8

Total Wages

Line 9

Excess Wages

Line 10

Taxable Wages

Line 11

UI Rate

Line 12

AC Rate **

Line 13

Total Tax Due

* Interest Due

* Interest should be calculated at 1% per month on total tax due

**For adjustments prior to 2002 do not use AC Rate

Balance or Credit Due

CORRECTIONS - PART 2 (Wage Report)

Social Security #

Employee Name

Amount Previously

Correct Amount

Reported

SIGNATURE_________________________

TITLE__________________

DATE_________________

PHONE______________

NHES is a proud member of America's Workforce Network and NH WORKS. NHES is an Equal Opportunity Employer and

complies with the Americans with Disabilities Act. Auxiliary aids and services are available upon request of individuals with disabilities.

Telephone: (603)224-3311

Fax: (603)229-4323

Web:

TDD ACCESS: RELAY NH 1(800)735-2964

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1