Form 4 (W-8ben Sub1) - Non-Us Entities Or Individuals Receiving Funds For Work Conducted Wholly Or Partly In The Us

ADVERTISEMENT

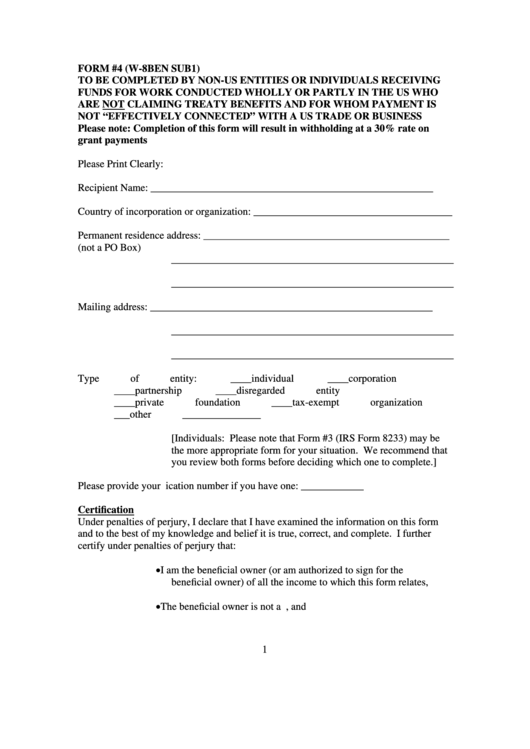

FORM #4 (W-8BEN SUB1)

TO BE COMPLETED BY NON-US ENTITIES OR INDIVIDUALS RECEIVING

FUNDS FOR WORK CONDUCTED WHOLLY OR PARTLY IN THE US WHO

ARE NOT CLAIMING TREATY BENEFITS AND FOR WHOM PAYMENT IS

NOT “EFFECTIVELY CONNECTED” WITH A US TRADE OR BUSINESS

Please note: Completion of this form will result in withholding at a 30% rate on

grant payments

Please Print Clearly:

Recipient Name:

______________________________________________________

Country of incorporation or organization: ______________________________________

Permanent residence address: _______________________________________________

(not a PO Box)

______________________________________________________

______________________________________________________

Mailing address:

______________________________________________________

______________________________________________________

______________________________________________________

Type of entity:

____individual

____corporation

____partnership

____disregarded entity

____private foundation

____tax-exempt organization

___other _______________

[Individuals: Please note that Form #3 (IRS Form 8233) may be

the more appropriate form for your situation. We recommend that

you review both forms before deciding which one to complete.]

Please provide your U.S. taxpayer identification number if you have one: ____________

Certification

Under penalties of perjury, I declare that I have examined the information on this form

and to the best of my knowledge and belief it is true, correct, and complete. I further

certify under penalties of perjury that:

• I am the beneficial owner (or am authorized to sign for the

beneficial owner) of all the income to which this form relates,

• The beneficial owner is not a U.S. person, and

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2