Form 593-W C2 - Real Estate Withholding Exemption Certificate And Waiver Request For Non-Individual Sellers 2003

ADVERTISEMENT

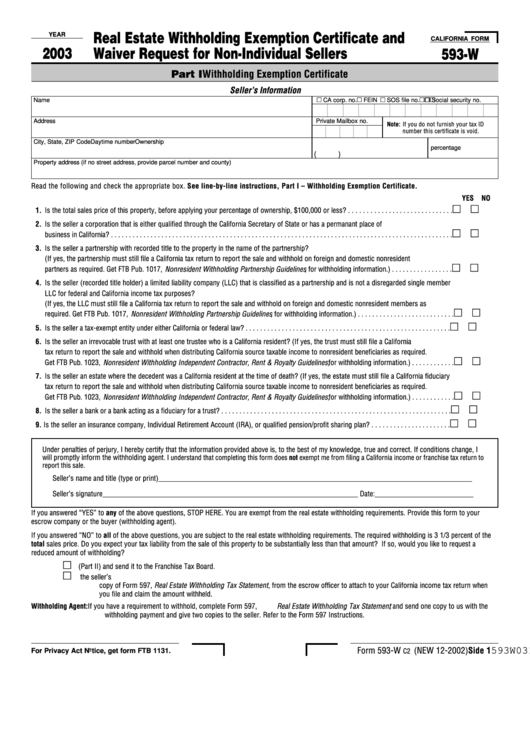

YEAR

Real Estate Withholding Exemption Certificate and

CALIFORNIA FORM

2003

Waiver Request for Non-Individual Sellers

593-W

Part I Withholding Exemption Certificate

Seller’s Information

Name

CA corp. no.

FEIN

SOS file no.

Social security no.

Address

Private Mailbox no.

Note: If you do not furnish your tax ID

number this certificate is void.

City, State, ZIP Code

Daytime number

Ownership

percentage

(

)

Property address (if no street address, provide parcel number and county)

Read the following and check the appropriate box. See line-by-line instructions, Part I – Withholding Exemption Certificate.

YES NO

1. Is the total sales price of this property, before applying your percentage of ownership, $100,000 or less? . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2. Is the seller a corporation that is either qualified through the California Secretary of State or has a permanant place of

business in California? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3. Is the seller a partnership with recorded title to the property in the name of the partnership?

(If yes, the partnership must still file a California tax return to report the sale and withhold on foreign and domestic nonresident

partners as required. Get FTB Pub. 1017, Nonresident Withholding Partnership Guidelines , for withholding information.) . . . . . . . . . . . . . . . . .

4. Is the seller (recorded title holder) a limited liability company (LLC) that is classified as a partnership and is not a disregarded single member

LLC for federal and California income tax purposes?

(If yes, the LLC must still file a California tax return to report the sale and withhold on foreign and domestic nonresident members as

required. Get FTB Pub. 1017, Nonresident Withholding Partnership Guidelines , for withholding information.) . . . . . . . . . . . . . . . . . . . . . . . . . . .

5. Is the seller a tax-exempt entity under either California or federal law? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6. Is the seller an irrevocable trust with at least one trustee who is a California resident? (If yes, the trust must still file a California

tax return to report the sale and withhold when distributing California source taxable income to nonresident beneficiaries as required.

Get FTB Pub. 1023, Nonresident Withholding Independent Contractor, Rent & Royalty Guidelines, for withholding information.) . . . . . . . . . . . .

7. Is the seller an estate where the decedent was a California resident at the time of death? (If yes, the estate must still file a California fiduciary

tax return to report the sale and withhold when distributing California source taxable income to nonresident beneficiaries as required.

Get FTB Pub. 1023, Nonresident Withholding Independent Contractor, Rent & Royalty Guidelines, for withholding information.) . . . . . . . . . . . .

8. Is the seller a bank or a bank acting as a fiduciary for a trust? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9. Is the seller an insurance company, Individual Retirement Account (IRA), or qualified pension/profit sharing plan? . . . . . . . . . . . . . . . . . . . . . .

Under penalties of perjury, I hereby certify that the information provided above is, to the best of my knowledge, true and correct. If conditions change, I

will promptly inform the withholding agent

. I understand that completing this form does not exempt me from filing a California income or franchise tax return to

report this sale.

Seller’s name and title (type or print)______________________________________________________________________________________

Seller’s signature______________________________________________________________________ Date:___________________________

If you answered “YES” to any of the above questions, STOP HERE. You are exempt from the real estate withholding requirements. Provide this form to your

escrow company or the buyer (withholding agent).

If you answered “NO” to all of the above questions, you are subject to the real estate withholding requirements. The required withholding is 3 1/3 percent of the

total sales price. Do you expect your tax liability from the sale of this property to be substantially less than that amount? If so, would you like to request a

reduced amount of withholding?

Yes.

Complete the Withholding Waiver Request (Part II) and send it to the Franchise Tax Board.

No.

STOP HERE. Your escrow officer will withhold 3 1/3 percent of the total sales price and send it to us on your behalf. Obtain the seller’s

copy of Form 597, Real Estate Withholding Tax Statement , from the escrow officer to attach to your California income tax return when

you file and claim the amount withheld.

Withholding Agent:

If you have a requirement to withhold, complete Form 597, Real Estate Withholding Tax Statement , and send one copy to us with the

withholding payment and give two copies to the seller. Refer to the Form 597 Instructions.

593W03103

Form 593-W

(NEW 12-2002) Side 1

For Privacy Act Notice, get form FTB 1131.

C2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2