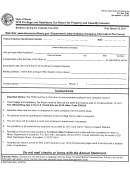

Sample Waiver Form - California Department Of Insurance Page 2

ADVERTISEMENT

Please be advised that the provisions of AB 2883 are applicable to all in-force policies

as of January 1, 2017, and that unless a duly executed waiver is received and accepted

by the insurance carrier on or before January 1, 2017, any individual that had been

exempted from coverage under the workers’ compensation policy, including but not

limited to, an officer or member of the board of directors of a corporation, or

an individual who is a general partner of a partnership or a managing member of a

limited liability company, will need to be added to the coverage provided by the insurer

until such time as a duly executed waiver is received and accepted by the insurer. Both

the Department and the Department of Industrial Relations (DIR) have concluded that

because AB 2883 does not exempt in-force policies, on its effective date of January 1,

2017, AB 2883 applies to all in-force policies. The Department recognizes that this law

may require mid-term changes to in-force policies that are inconsistent with how the

policies were marketed to the employers. Nevertheless, regardless of whether the

insurer decides to actually collect premium for a reasonable transition period

commencing January 1, 2017 (not to exceed 90 days), for such additions to the policy,

in order to effectively implement this change in law, the Department will expect insurers

to take the following actions:

•

Provide as soon as possible, but in no event later than November 15, 2016,

an

advisory/explanatory notice, with a copy of the waiver form to each employer

that may have employees who are currently excluded from coverage and may

be affected by this change in law. For your reference and use, a sample waiver

form prepared by the DIR is attached, and

•

Create an acknowledgement process to provide insureds with the date of

receipt and acceptance of the waiver(s), and

•

Determine and report to the WCIRB, consistent with existing practices, the

premium and loss experience associated with officers or members of the board

of directors of a corporation, or individuals who are general partners of a

partnership or managing members of a limited liability company who have not

executed a waiver as covered employees, and

•

Pay premium tax and assessments associated with such additional premium.

If you have any questions concerning this notice, please contact Patricia Hein, Attorney

IV, California Department of Insurance, e-mail at: Patricia.Hein@insurance.ca.gov.

Questions concerning the sample waiver may be directed to the DIR at:

AB2883@dir.ca.gov.

John F. Finston

General Counsel & Deputy Commissioner

2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4