0600103

FRX

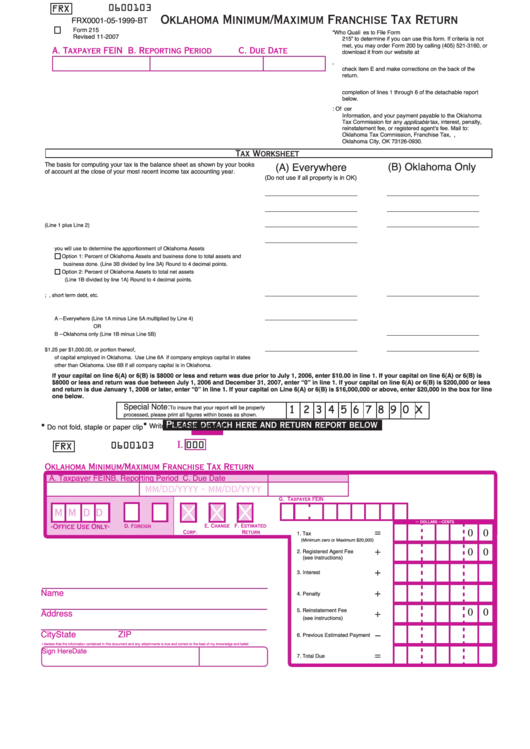

Oklahoma Minimum/Maximum Franchise Tax Return

FRX0001-05-1999-BT

Form 215

1. Read the instructions on back “Who Qualifies to File Form

Revised 11-2007

215” to determine if you can use this form. If criteria is not

met, you may order Form 200 by calling (405) 521-3160, or

A. Taxpayer FEIN

B. Reporting Period

C. Due Date

download it from our website at

2. If any of the preprinted information on this form is incorrect,

check item E and make corrections on the back of the

return.

3. Follow the instructions on the back of this form for the

completion of lines 1 through 6 of the detachable report

below.

4. Detach the return below and mail with Schedule A: Officer

Information, and your payment payable to the Oklahoma

applicable

Tax Commission for any

tax, interest, penalty,

reinstatement fee, or registered agent’s fee. Mail to:

Oklahoma Tax Commission, Franchise Tax, P.O. Box 26930,

Oklahoma City, OK 73126-0930.

Tax Worksheet

The basis for computing your tax is the balance sheet as shown by your books

(B) Oklahoma Only

(A) Everywhere

of account at the close of your most recent income tax accounting year.

(Do not use if all property is in OK)

1. Enter total company assets

2. Enter business done

3. Total assets and business done (Line 1 plus Line 2)

4. Percentage of capital employed in Oklahoma. Select the option

you will use to determine the apportionment of Oklahoma Assets

Option 1: Percent of Oklahoma Assets and business done to total assets and

business done. (Line 3B divided by line 3A) Round to 4 decimal points.

Option 2: Percent of Oklahoma Assets to total net assets

(Line 1B divided by line 1A) Round to 4 decimal points.

5. Enter total current company liabilities; i.e. accounts payable, short term debt, etc.

6. Calculate the capital employed in Oklahoma

A --Everywhere (Line 1A minus Line 5A multiplied by Line 4)

OR

B --Oklahoma only (Line 1B minus Line 5B)

7. Calculate your franchise tax. The tax rate is $1.25 per $1,000.00, or portion thereof,

of capital employed in Oklahoma. Use Line 6A if company employs capital in states

other than Oklahoma. Use 6B if all company capital is in Oklahoma.

If your capital on line 6(A) or 6(B) is $8000 or less and return was due prior to July 1, 2006, enter $10.00 in line 1. If your capital on line 6(A) or 6(B) is

$8000 or less and return was due between July 1, 2006 and December 31, 2007, enter “0” in line 1. If your capital on line 6(A) or 6(B) is $200,000 or less

and return is due January 1, 2008 or later, enter “0” in line 1. If your capital on Line 6(A) or 6(B) is $16,000,000 or above, enter $20,000 in the box for line

one below.

Special Note:

1 2 3 4 5 6 7 8 9 0 X

To insure that your report will be properly

processed, please print all figures within boxes as shown.

•

•

Please detach here and return report below

Write only in white areas

Do not fold, staple or paper clip

I.

000

0600103

FRX

Oklahoma Minimum/Maximum Franchise Tax Return

A. Taxpayer FEIN

B. Reporting Period

C. Due Date

mm/dd/yyyy - mm/dd/yyyy

G. Taxpayer FEIN

M M D D

-- dollars --

cents

-Office Use Only-

F.C.

P.T.

D. Foreign

E. Change F. Estimated

=

0 0

Corp.

Return

1. Tax

(Minimum zero or Maximum $20,000)

+

0 0

2. Registered Agent Fee

(see instructions)

+

3. Interest

Name

+

4. Penalty

5. Reinstatement Fee

0 0

Address

+

(see instructions)

City

State

ZIP

6. Previous Estimated Payment

I declare that the information contained in this document and any attachments is true and correct to the best of my knowledge and belief.

Sign Here

Date

=

7. Total Due

1

1 2

2 3

3