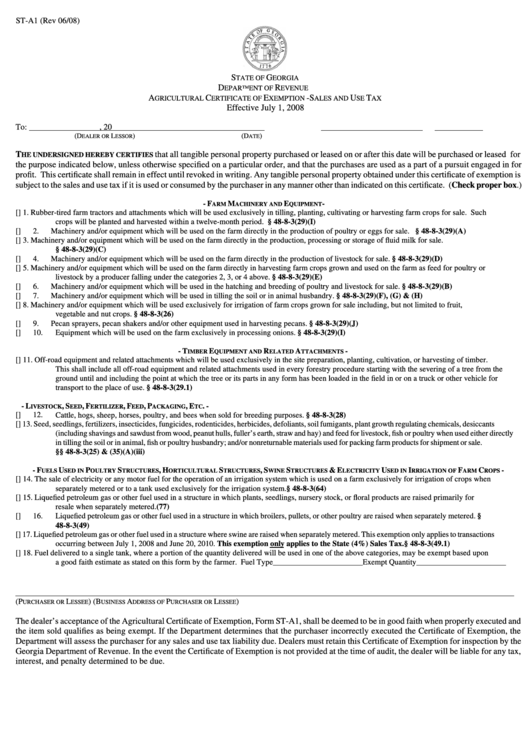

Form St-A1 Agricultural Certificate Of Exemption - Sales And Use Tax

ADVERTISEMENT

ST-A1 (Rev 06/08)

S

G

TATE OF

EORGIA

D

R

EPARTMENT OF

EVENUE

A

C

E

- S

U

T

GRICULTURAL

ERTIFICATE OF

XEMPTION

ALES AND

SE

AX

Effective July 1, 2008

To:

, 20

(D

L

)

(D

)

EALER OR

ESSOR

ATE

T

that all tangible personal property purchased or leased on or after this date will be purchased or leased for

HE UNDERSIGNED HEREBY CERTIFIES

the purpose indicated below, unless otherwise specified on a particular order, and that the purchases are used as a part of a pursuit engaged in for

profit. This certificate shall remain in effect until revoked in writing. Any tangible personal property obtained under this certificate of exemption is

subject to the sales and use tax if it is used or consumed by the purchaser in any manner other than indicated on this certificate. (Check proper box.)

- F

M

E

-

ARM

ACHINERY AND

QUIPMENT

[ ]

1.

Rubber-tired farm tractors and attachments which will be used exclusively in tilling, planting, cultivating or harvesting farm crops for sale. Such

crops will be planted and harvested within a twelve-month period. O.C.G.A. § 48-8-3(29)(I)

[ ]

2.

Machinery and/or equipment which will be used on the farm directly in the production of poultry or eggs for sale. O.C.G.A. § 48-8-3(29)(A)

[ ]

3.

Machinery and/or equipment which will be used on the farm directly in the production, processing or storage of fluid milk for sale.

O.C.G.A. § 48-8-3(29)(C)

[ ]

4.

Machinery and/or equipment which will be used on the farm directly in the production of livestock for sale. O.C.G.A.§ 48-8-3(29)(D)

[ ]

5.

Machinery and/or equipment which will be used on the farm directly in harvesting farm crops grown and used on the farm as feed for poultry or

livestock by a producer falling under the categories 2, 3, or 4 above. O.C.G.A. § 48-8-3(29)(E)

[ ]

6.

Machinery and/or equipment which will be used in the hatching and breeding of poultry and livestock for sale. O.C.G.A. § 48-8-3(29)(B)

[ ]

7.

Machinery and/or equipment which will be used in tilling the soil or in animal husbandry. O.C.G.A. § 48-8-3(29)(F), (G) & (H)

[ ]

8.

Machinery and/or equipment which will be used exclusively for irrigation of farm crops grown for sale including, but not limited to fruit,

vegetable and nut crops. O.C.G.A. § 48-8-3(26)

[ ]

9.

Pecan sprayers, pecan shakers and/or other equipment used in harvesting pecans. O.C.G.A. § 48-8-3(29)(J)

[ ]

10.

Equipment which will be used on the farm exclusively in processing onions. O.C.G.A.§ 48-8-3(29)(I)

- T

E

R

A

-

IMBER

QUIPMENT AND

ELATED

TTACHMENTS

[ ]

11.

Off-road equipment and related attachments which will be used exclusively in the site preparation, planting, cultivation, or harvesting of timber.

This shall include all off-road equipment and related attachments used in every forestry procedure starting with the severing of a tree from the

ground until and including the point at which the tree or its parts in any form has been loaded in the field in or on a truck or other vehicle for

transport to the place of use. O.C.G.A. § 48-8-3(29.1)

- L

, S

, F

, F

, P

, E

. -

IVESTOCK

EED

ERTILIZER

EED

ACKAGING

TC

[ ]

12.

Cattle, hogs, sheep, horses, poultry, and bees when sold for breeding purposes. O.C.G.A. § 48-8-3(28)

[ ]

13.

Seed, seedlings, fertilizers, insecticides, fungicides, rodenticides, herbicides, defoliants, soil fumigants, plant growth regulating chemicals, desiccants

(including shavings and sawdust from wood, peanut hulls, fuller’s earth, straw and hay) and feed for livestock, fish or poultry when used either directly

in tilling the soil or in animal, fish or poultry husbandry; and/or nonreturnable materials used for packing farm products for shipment or sale. O.C.G.A.

§§ 48-8-3(25) & (35)(A)(iii)

- F

U

P

S

, H

S

, S

S

& E

U

I

F

C

-

UELS

SED IN

OULTRY

TRUCTURES

ORTICULTURAL

TRUCTURES

WINE

TRUCTURES

LECTRICITY

SED IN

RRIGATION OF

ARM

ROPS

[ ]

14.

The sale of electricity or any motor fuel for the operation of an irrigation system which is used on a farm exclusively for irrigation of crops when

separately metered or to a tank used exclusively for the irrigation system. O.C.G.A. § 48-8-3(64)

[ ]

15.

Liquefied petroleum gas or other fuel used in a structure in which plants, seedlings, nursery stock, or floral products are raised primarily for

resale when separately metered. O.C.G.A. 48-8-3(77)

[ ]

16.

Liquefied petroleum gas or other fuel used in a structure in which broilers, pullets, or other poultry are raised when separately metered. O.C.G.A. §

48-8-3(49)

[ ]

17.

Liquefied petroleum gas or other fuel used in a structure where swine are raised when separately metered. This exemption only applies to transactions

occurring between July 1, 2008 and June 20, 2010. This exemption only applies to the State (4%) Sales Tax. O.C.G.A. § 48-8-3(49.1)

[ ]

18.

Fuel delivered to a single tank, where a portion of the quantity delivered will be used in one of the above categories, may be exempt based upon

a good faith estimate as stated on this form by the farmer. Fuel Type_______________________Exempt Quantity_______________________

(P

L

)

(B

A

P

L

)

URCHASER OR

ESSEE

USINESS

DDRESS OF

URCHASER OR

ESSEE

The dealer’s acceptance of the Agricultural Certificate of Exemption, Form ST-A1, shall be deemed to be in good faith when properly executed and

the item sold qualifies as being exempt. If the Department determines that the purchaser incorrectly executed the Certificate of Exemption, the

Department will assess the purchaser for any sales and use tax liability due. Dealers must retain this Certificate of Exemption for inspection by the

Georgia Department of Revenue. In the event the Certificate of Exemption is not provided at the time of audit, the dealer will be liable for any tax,

interest, and penalty determined to be due.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1