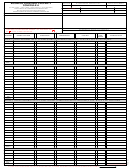

BUSINESS PERSONAL PROPERTY SCHEDULE B

INVENTORY

THIS SCHEDULE IS CONSIDERED CONFIDENTIAL AND NOT OPEN TO PUBLIC INSPECTION

SCHEDULE B - INVENTORY - SEE INSTRUCTION SHEET

Did you or your business own any inventory on January 1, this year? Yes ( ) No ( ).

1. Indicate your inventory accounting method (Lower of Cost or Market, Retail

If yes, please list in space provided below. Show total 100% cost, do not include

Method, Weighted Average, Physical, etc.)

licensed motor vehicles, or dealer heavy duty equipment for sale weighing over

2. Check Cost Method as it applies to your inventory:

( ) Actual ( ) LIFO

5,000 pounds and to be used for construction purposes.

( ) FIFO LIFO not acceptable

1. Merchandise

3

Fiscal Year ending date of business

If your Fiscal Year ends at a point in time other than January 1, you should attach

2. Raw Materials

a breakdown of how you arrived at your January 1 inventory.

4. Inventory reported on previous year Georgia Income Tax Return:

3. Goods in Process

5. The 100% delivered cost should include freight, burden and overhead at your

level of trade on January 1.

4. Finished Goods

6.

If you file a Corporate or Partnership Income Tax Return, a photocopy of your

5. Goods in Transit

most current balance sheet (Corporation. Form 1120, Schedule A & L - Partnership,

Form 1065, Schedule A & L) as filed with your U.S. Income Tax Return is requested.

6. Warehoused

If you filed an Individual or Sole Proprietorship Income Tax Return, a photo copy

of your most current Profit or Loss Statement Form 1040, Schedule C, Pages 1 &

7. Consigned

2 as filed with your U.S. Income Tax Return is requested. These documents are

8. Floor Planned

requested for inventory verification purposes and will not be available for public

inspection (O.C.G.A. § 48-5-314). Under GA Law you cannot be required to furnish

9. Spare Parts

any Income Tax Records or Returns.

7. Inventory is subject to audit and verification from your records or those you have

10. Supplies

Includes computer, medical, office and operating

filed with the State of Georgia Department of Revenue.

supplies, fuel, and tangible prepaid expensed items)

8. Do not make any deductions for anticipated mark-down or shrinkage. Do not

11. Packaging Materials

discount, figures are to be taken directly from your books.

9. If inventory is less than the previous year an explanation for the decrease should

12. Livestock

be submitted.

(Non Exempt 48-5-41.1)

10. Gross Sales for the previous calendar year:

13. TOTAL INVENTORY

11. All taxable livestock and farm products should be reported as inventory. See

Enter total on page 1 Line I schedule column. If Freeport account

O.C.G.A. § 48-5-41.1 for details of exemption.

enter exempt amount on Line P and taxable amount on Line I.

SCHEDULE C - CONSTRUCTION IN PROGRESS

Did you have unallocated costs for construction in progress on January 1 this year? Yes ( ) No ( ). If yes, did you have tangible personal property connected with

this construction in progress that has not been reported in any other section of this schedule? Yes ( ) No ( ) If yes, please list in the space provided below. Add

Indicated Value to Total on Page 1 Line F Schedule Column.

MARKET

YEAR

USEFUL

TOTAL

DETAILED DESCRIPTION OF ITEMS

INDICATED

OFFICE USE

=

X

LIFE

VALUE

ACQUIRED

(ATTACH SUPPLEMENTAL SHEETS IF NEEDED)

COST

VALUE

ONLY

FACTOR

(YEARS)

=

X

.75

SECTION 1: CONSIGNED GOODS

Did you have any consigned goods, floor planned merchandise, or any other type of goods that were loaned, stored or otherwise held on January 1, this year, and

not owned by you and was not reported in your inventory value in schedule B above of this report? Yes ( ) No ( ). If yes, list in the space provided below.

FULL

DESCRIPTION OF GOODS

NAME AND ADDRESS OF LEGAL OWNER

COST

(ATTACH SUPPLEMENTAL SHEETS IF NEEDED)

SECTION 2: LEASED OR RENTED EQUIPMENT

Did you have in your possession or was there located at your business on January 1, this year, any machinery, equipment, furniture, fixture, tools, vending

machines (coffee, cigarette, candy, games etc.) or other type personal property which was leased, rented, loaned, stored or otherwise located at your business and

not owned by you? Yes ( ) No ( ). If yes, list the equipment in the space provided below (exclude licensed motor vehicles). Attach supplemental sheet if necessary.

RENTAL

SELLING

DATE

DATE OF

LENGTH

NAME/ADDRESS OF OWNER

AMOUNT

DESCRIPTION OF ITEM

PRICE

MANUFACTURE

INSTALLED

OF LEASE

PER MONTH

SECTION 3: ADDITIONS OR ITEMS TRANSFERRED IN

Did you have items which were added or transferred in for prior years or the current year that were not previously reported? Yes ( ) No ( ). If yes, list in the space provided below.

DETAILED DESCRIPTION OF ITEMS ( ATTACH SUPPLEMENTAL SHEETS IF NEEDED )

YEAR ACQUIRED

ORIGINAL COST NEW

SECTION 4: DISPOSALS OR ITEMS TRANSFERRED OUT

Did you have items which have been sold, junked, transferred or otherwise no longer located at the business January 1 this year? Yes ( ) No ( ). If yes, list in the

space provided below.

DETAILED DESCRIPTION OF ITEMS

YEAR

REASON

IF EQUIPMENT SOLD, NAME AND ADDRESS OF

DATE

ORIGINAL COST

(ATTACH SUPPLEMENTAL SHEETS IF NEEDED)

ACQUIRED

PURCHASER SHOULD BE LISTED BELOW

DISPOSED

NEW

PAGE 4

1

1 2

2 3

3 4

4