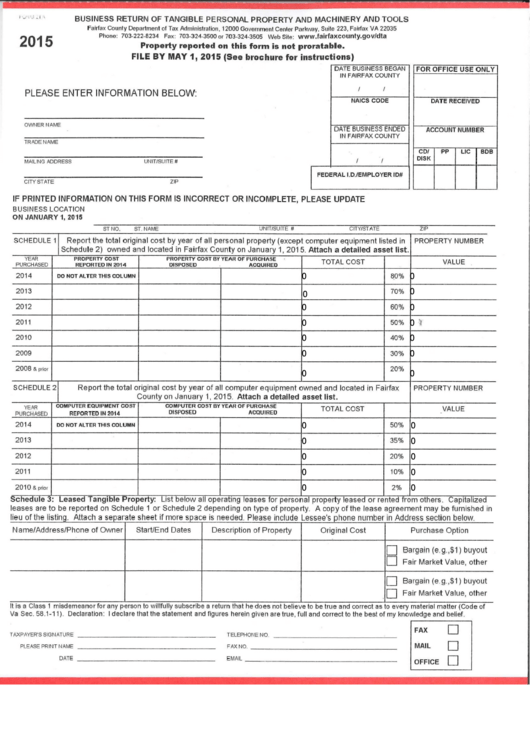

2015

BUSINESS RETURN OF TANGIBLE PERSONAL PROPERTY AND MACHINERY AND TOOLS

Fairfax County Department of Tax Administration, 12000 Government Center Parkway, Suite 223, Fairfax VA 22035

Phone: 703-222-8234 Fax: 703-324-3500 or 703-324-3505

Web Site:

Property reported on this form is not proratable.

FILE BY MAY 1, 2015 (See brochure for instructions)

PLEASE ENTER INFORMATION BELOW:

OWNER NAME

TRADENAME

MAILING ADDRESS

UNIT/SUITE#

DATE BUSINESS BEGAN

IN FAIRFAX COUNTY

NAICS CODE

DATE BUSINESS ENDED

IN FAIRFAX COUNTY

FEDERAL I.D./EMPLOYER ID#

FOR OFFICE USE ONLY

DATE RECEIVED

ACCOUNT NUMBER

CD/

DISK

PP

LIC

BDB

IF PRINTED INFORMATION ON THIS FORM IS INCORRECT OR INCOMPLETE, PLEASE UPDATE

BUSINESS LOCATION

ON JANUARY 1, 2015

UNIT/SUITE #

CITY/STATE

ZIP

SCHEDULE 1

Report the total original cost by year of all personal property (except computer equipment listed in

Schedule

2)

owned and located in Fairfax County on January 1,

2015.

Attach a detailed asset list.

PROPERTY NUMBER

YEAR

PURCHASED

PROPERTY COST

REPORTED IN 2014

PROPERTY COST BY YEAR OF PURCHASE

DISPOSED

ACQUIRED

TOTAL COST

VALUE

2014

DO NOT ALTER THIS COLUMN

80%

2013

70%

2012

60%

2011

50%

*

2010

40%

2009

30%

2008 &

prior

20%

SCHEDULE 2

Report the total original cost by year of all computer equipment owned and located in Fairfax

County on January

1, 2015.

Attach a detailed asset list.

PROPERTY NUMBER

YEAR

PURCHASED

COMPUTER EQUIPMENT COST

REPORTED IN 2014

COMPUTER COST BY YEAR OF PURCHASE

DISPOSED

ACQUIRED

TOTAL COST

VALUE

2014

DO NOT ALTER THIS COLUMN

50%

2013

35%

2012

20%

2011

10%

201 0 &

prior

2%

Schedule 3: Leased Tangible Property: List below all operating leases for personal property leased or rented from others. Capitalized

leases are to be reported on Schedule 1 or Schedule 2 depending on type of property. A copy of the lease agreement may be furnished in

Name/Address/Phone of Owner

Start/End Dates

Description of Property

Original Cost

Purchase Option

|

| Bargain (e.g.,$1) buyout

I

I Fair Market Value, other

|

| Bargain (e.g.,$1) buyout

|

| Fair Market Value, other

It is a Class 1 misdemeanor for any person to willfully subscribe a return that he does not believe to be true and correct as to every material matter (Code of

Va Sec. 58.1-11), Declaration: I declare that the statement and figures herein given are true, full and correct to the best of my knowledge and belief.

TAXPAYER'S SIGNATURE

TELEPHONE NO.

.

FAX

•

PLEASE PRINT NAME

FAX NO.

MAIL

•

•

DATE

EMAIL

OFFICE

•

•

OFFICE

•

•

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

1

1