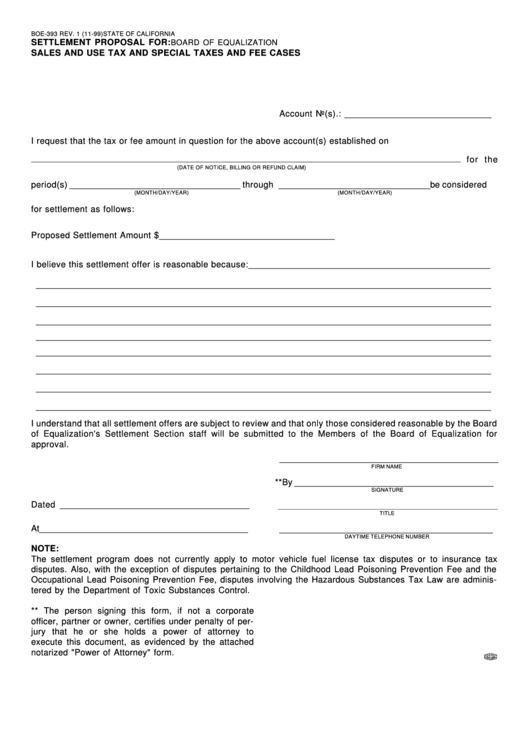

Form Boe-393 - Settlement Proposal For Sales And Use Tax And Special Taxes And Fee Cases

ADVERTISEMENT

BOE-393 REV. 1 (11-99)

STATE OF CALIFORNIA

SETTLEMENT PROPOSAL FOR:

BOARD OF EQUALIZATION

SALES AND USE TAX AND SPECIAL TAXES AND FEE CASES

Account No(s).: _______________________________

I request that the tax or fee amount in question for the above account(s) established on

for the

(DATE OF NOTICE, BILLING OR REFUND CLAIM)

period(s) ____________________________________ through ________________________________ be considered

(MONTH/DAY/YEAR)

(MONTH/DAY/YEAR)

for settlement as follows:

Proposed Settlement Amount $ _____________________________________

I believe this settlement offer is reasonable because: ___________________________________________________

________________________________________________________________________________________________

________________________________________________________________________________________________

________________________________________________________________________________________________

________________________________________________________________________________________________

________________________________________________________________________________________________

________________________________________________________________________________________________

________________________________________________________________________________________________

________________________________________________________________________________________________

I understand that all settlement offers are subject to review and that only those considered reasonable by the Board

of Equalization's Settlement Section staff will be submitted to the Members of the Board of Equalization for

approval.

__________________________________________________

FIRM NAME

**By __________________________________________

SIGNATURE

Dated ________________________________________

___________________________________________________________________________

TITLE

At ____________________________________________

_____________________________________________

DAYTIME TELEPHONE NUMBER

NOTE:

The settlement program does not currently apply to motor vehicle fuel license tax disputes or to insurance tax

disputes. Also, with the exception of disputes pertaining to the Childhood Lead Poisoning Prevention Fee and the

Occupational Lead Poisoning Prevention Fee, disputes involving the Hazardous Substances Tax Law are adminis-

tered by the Department of Toxic Substances Control.

** The person signing this form, if not a corporate

officer, partner or owner, certifies under penalty of per-

jury that he or she holds a power of attorney to

execute this document, as evidenced by the attached

notarized "Power of Attorney" form.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1