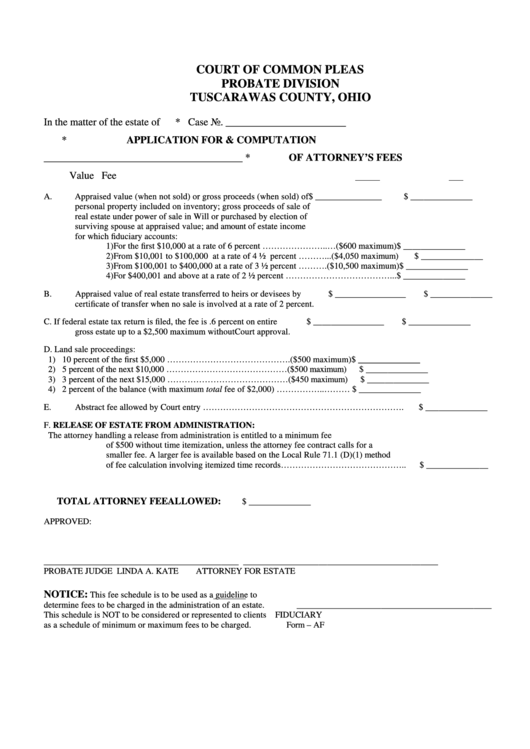

Form - Af Application For & Computation Of Attorney'S Fees

ADVERTISEMENT

COURT OF COMMON PLEAS

PROBATE DIVISION

TUSCARAWAS COUNTY, OHIO

In the matter of the estate of

*

Case No. _______________________

*

APPLICATION FOR & COMPUTATION

______________________________________

*

OF ATTORNEY’S FEES

Value

Fee

A.

Appraised value (when not sold) or gross proceeds (when sold) of

$ _______________

$ ______________

personal property included on inventory; gross proceeds of sale of

real estate under power of sale in Will or purchased by election of

surviving spouse at appraised value; and amount of estate income

for which fiduciary accounts:

1) For the first $10,000 at a rate of 6 percent …………………..…($600 maximum)

$ ______________

2) From $10,001 to $100,000 at a rate of 4 ½ percent ………...($4,050 maximum)

$ ______________

3) From $100,001 to $400,000 at a rate of 3 ½ percent ……….($10,500 maximum)

$ ______________

4) For $400,001 and above at a rate of 2 ½ percent ………………………………...

$ ______________

B.

Appraised value of real estate transferred to heirs or devisees by

$ ________________

$ ______________

certificate of transfer when no sale is involved at a rate of 2 percent.

C.

If federal estate tax return is filed, the fee is .6 percent on entire

$ ________________

$ ______________

gross estate up to a $2,500 maximum without Court approval.

D.

Land sale proceedings:

1) 10 percent of the first $5,000 …………………………………….($500 maximum)

$ ______________

2) 5 percent of the next $10,000 ……………………………………($500 maximum)

$ ______________

3) 3 percent of the next $15,000 ……………………………………($450 maximum)

$ ______________

4) 2 percent of the balance (with maximum total fee of $2,000) ……………..………

$ ______________

E.

Abstract fee allowed by Court entry …………………………………………………………….

$ ______________

F.

RELEASE OF ESTATE FROM ADMINISTRATION:

The attorney handling a release from administration is entitled to a minimum fee

of $500 without time itemization, unless the attorney fee contract calls for a

smaller fee. A larger fee is available based on the Local Rule 71.1 (D)(1) method

of fee calculation involving itemized time records……………………………………..

$ ______________

TOTAL ATTORNEY FEE ALLOWED:

$ ______________

APPROVED:

____________________________________________

____________________________________________

PROBATE JUDGE LINDA A. KATE

ATTORNEY FOR ESTATE

NOTICE:

This fee schedule is to be used as a guideline to

determine fees to be charged in the administration of an estate.

____________________________________________

This schedule is NOT to be considered or represented to clients

FIDUCIARY

as a schedule of minimum or maximum fees to be charged.

Form – AF

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1