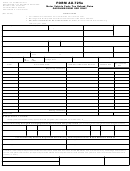

Form Au-725a - Motor Vehicle Fuels Tax Refund Claim - 2002 Page 2

ADVERTISEMENT

Instructions

Your motor vehicle fuels tax refund claim for gasoline

•

Name and address of the purchaser (which must

used during calendar year 2002 must:

be the name and address of the person or entity

filing the claim for refund);

1.

Be filed with DRS on or before May 31, 2003; and

•

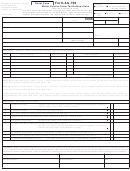

Number of gallons of gasoline purchased;

2.

Include at least 200 gallons of fuel eligible for tax

refund.

•

Price per gallon; and

•

Total amount paid.

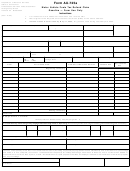

Be sure to provide a telephone number where you can

be contacted.

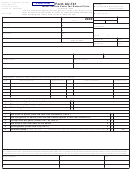

You must retain records that substantiate your refund

claim for at least three years following the filing of the

You must indicate your Connecticut tax registration

claim and make them available to DRS upon request.

number or Social Security Number in the space

provided.

You must include a copy of your current Form

OR-248, Farmer Tax Exemption Permit . Failure to

For all purchases of gasoline listed, you must attach

do so will result in your refund claim being

a copy of each numbered slip or invoice that was issued

reduced by your Connecticut business use tax

at the time of the purchase. The slip or invoice may be

liability.

the original or a photocopy and must show the:

•

Date of purchase;

•

Name and address of the seller (which must be

printed or rubber stamped on the slip or invoice);

Additional Information

If you need additional information or assistance, please

Your refund will be applied against any

call the Excise/Public Services Taxes Subdivision at

outstanding DRS tax liability.

860-541-3225, Monday through Friday, 8:00 a.m. to

5:00 p.m. Forms may be downloaded from our Web site

at:

Form AU-725a Back (Rev. 11/02)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2