Income Tax Return Form - Village Of Westfield Center

ADVERTISEMENT

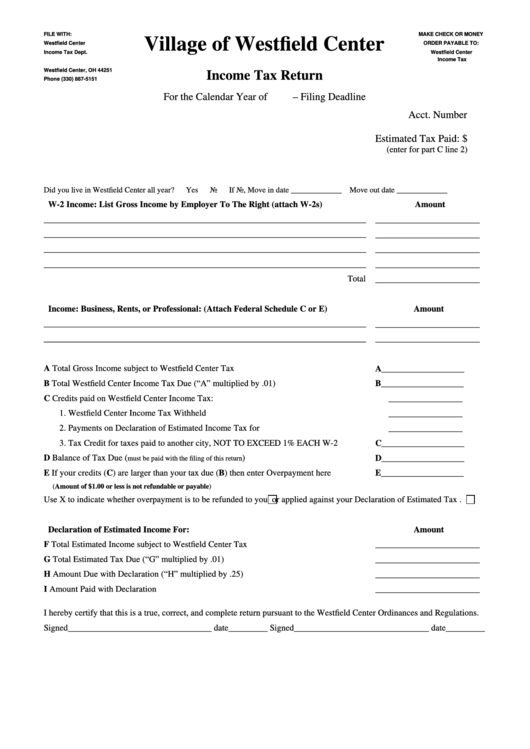

FILE WITH:

MAKE CHECK OR MONEY

Village of Westfield Center

Westfield Center

ORDER PAYABLE TO:

Income Tax Dept.

Westfield Center

P.O. Box 750

Income Tax

Westfield Center, OH 44251

Income Tax Return

Phone (330) 887-5151

For the Calendar Year of

– Filing Deadline

Acct. Number

Estimated Tax Paid: $

(enter for part C line 2)

Did you live in Westfield Center all year?

Yes

No

If No, Move in date _____________ Move out date _____________

W-2 Income: List Gross Income by Employer To The Right (attach W-2s)

Amount

__________________________________________________________________________

________________________

__________________________________________________________________________

________________________

__________________________________________________________________________

________________________

__________________________________________________________________________

________________________

Total

________________________

Income: Business, Rents, or Professional: (Attach Federal Schedule C or E)

Amount

__________________________________________________________________________

________________________

__________________________________________________________________________

________________________

A Total Gross Income subject to Westfield Center Tax

A___________________

B Total Westfield Center Income Tax Due (“A” multiplied by .01)

B___________________

C Credits paid on Westfield Center Income Tax:

_________________

1. Westfield Center Income Tax Withheld

_________________

2. Payments on Declaration of Estimated Income Tax for

_________________

3. Tax Credit for taxes paid to another city, NOT TO EXCEED 1% EACH W-2

C___________________

D Balance of Tax Due (

)

D___________________

must be paid with the filing of this return

E If your credits (C) are larger than your tax due (B) then enter Overpayment here

E___________________

(Amount of $1.00 or less is not refundable or payable)

Use X to indicate whether overpayment is to be refunded to you

or applied against your Declaration of Estimated Tax

.

Declaration of Estimated Income For:

Amount

F Total Estimated Income subject to Westfield Center Tax

________________________

G Total Estimated Tax Due (“G” multiplied by .01)

________________________

H Amount Due with Declaration (“H” multiplied by .25)

________________________

I Amount Paid with Declaration

________________________

I hereby certify that this is a true, correct, and complete return pursuant to the Westfield Center Ordinances and Regulations.

Signed_________________________________ date_________ Signed_______________________________ date_________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1