Form Dr 21 - Colorado Department Of Revenue (2007) With Instructions

ADVERTISEMENT

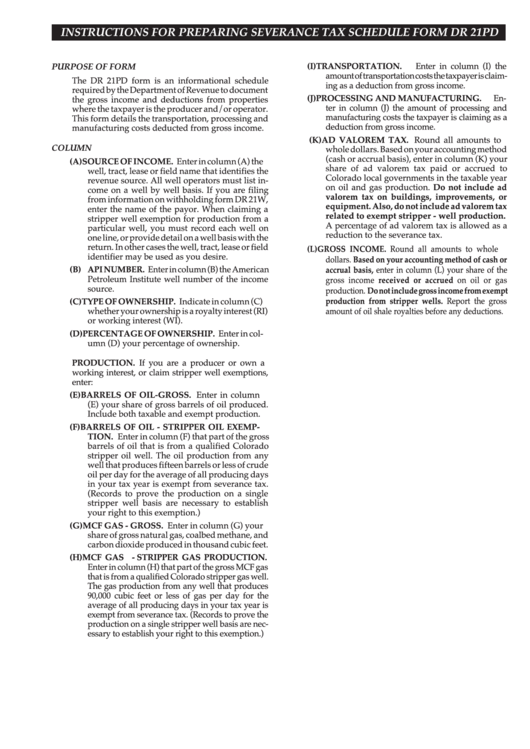

INSTRUCTIONS FOR PREPARING SEVERANCE TAX SCHEDULE FORM DR 21PD

(I) TRANSPORTATION. Enter in column (I) the

PURPOSE OF FORM

amount of transportation costs the taxpayer is claim-

The DR 21PD form is an informational schedule

ing as a deduction from gross income.

required by the Department of Revenue to document

(J) PROCESSING AND MANUFACTURING. En-

the gross income and deductions from properties

ter in column (J) the amount of processing and

where the taxpayer is the producer and/or operator.

manufacturing costs the taxpayer is claiming as a

This form details the transportation, processing and

deduction from gross income.

manufacturing costs deducted from gross income.

(K) AD VALOREM TAX. Round all amounts to

COLUMN

whole dollars. Based on your accounting method

(cash or accrual basis), enter in column (K) your

(A) SOURCE OF INCOME. Enter in column (A) the

share of ad valorem tax paid or accrued to

well, tract, lease or field name that identifies the

Colorado local governments in the taxable year

revenue source. All well operators must list in-

on oil and gas production. Do not include ad

come on a well by well basis. If you are filing

valorem tax on buildings, improvements, or

from information on withholding form DR 21W,

equipment. Also, do not include ad valorem tax

enter the name of the payor. When claiming a

related to exempt stripper - well production.

stripper well exemption for production from a

A percentage of ad valorem tax is allowed as a

particular well, you must record each well on

reduction to the severance tax.

one line, or provide detail on a well basis with the

return. In other cases the well, tract, lease or field

(L) GROSS INCOME. Round all amounts to whole

identifier may be used as you desire.

dollars. Based on your accounting method of cash or

(B) API NUMBER. Enter in column (B) the American

accrual basis, enter in column (L) your share of the

Petroleum Institute well number of the income

gross income received or accrued on oil or gas

source.

production. Do not include gross income from exempt

production from stripper wells. Report the gross

(C) TYPE OF OWNERSHIP. Indicate in column (C)

whether your ownership is a royalty interest (RI)

amount of oil shale royalties before any deductions.

or working interest (WI).

(D) PERCENTAGE OF OWNERSHIP. Enter in col-

umn (D) your percentage of ownership.

PRODUCTION. If you are a producer or own a

working interest, or claim stripper well exemptions,

enter:

(E) BARRELS OF OIL-GROSS. Enter in column

(E) your share of gross barrels of oil produced.

Include both taxable and exempt production.

(F) BARRELS OF OIL - STRIPPER OIL EXEMP-

TION. Enter in column (F) that part of the gross

barrels of oil that is from a qualified Colorado

stripper oil well. The oil production from any

well that produces fifteen barrels or less of crude

oil per day for the average of all producing days

in your tax year is exempt from severance tax.

(Records to prove the production on a single

stripper well basis are necessary to establish

your right to this exemption.)

(G) MCF GAS - GROSS. Enter in column (G) your

share of gross natural gas, coalbed methane, and

carbon dioxide produced in thousand cubic feet.

(H) MCF GAS - STRIPPER GAS PRODUCTION.

Enter in column (H) that part of the gross MCF gas

that is from a qualified Colorado stripper gas well.

The gas production from any well that produces

90,000 cubic feet or less of gas per day for the

average of all producing days in your tax year is

exempt from severance tax. (Records to prove the

production on a single stripper well basis are nec-

essary to establish your right to this exemption.)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2