Form Vat 58 - Claim By Unregistered Farmer For Refund Of Value Added Tax (Vat) Under The Value-Added Tax (Refund Of Tax) (Flat-Rate Farmers) Order

ADVERTISEMENT

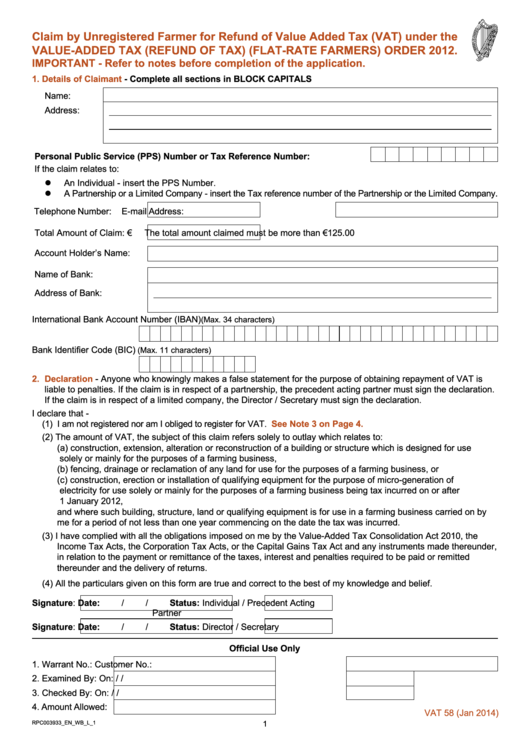

Claim by Unregistered Farmer for Refund of Value Added Tax (VAT) under the

VALUE-ADDED TAX (REFUND OF TAX) (FLAT-RATE FARMERS) ORDER 2012.

IMPORTANT - Refer to notes before completion of the application.

1. Details of Claimant

- Complete all sections in BLOCK CAPITALS

Name:

Address:

Personal Public Service (PPS) Number or Tax Reference Number:

If the claim relates to:

l An Individual - insert the PPS Number.

l A Partnership or a Limited Company - insert the Tax reference number of the Partnership or the Limited Company.

Telephone Number:

E-mail Address:

Total Amount of Claim: €

The total amount claimed must be more than €125.00

Account Holder’s Name:

Name of Bank:

Address of Bank:

International Bank Account Number (IBAN)

(Max. 34 characters)

Bank Identifier Code (BIC)

(Max. 11 characters)

2. Declaration

- Anyone who knowingly makes a false statement for the purpose of obtaining repayment of VAT is

liable to penalties. If the claim is in respect of a partnership, the precedent acting partner must sign the declaration.

If the claim is in respect of a limited company, the Director / Secretary must sign the declaration.

I declare that -

(1) I am not registered nor am I obliged to register for VAT.

See Note 3 on Page 4.

(2) The amount of VAT, the subject of this claim refers solely to outlay which relates to:

(a) construction, extension, alteration or reconstruction of a building or structure which is designed for use

solely or mainly for the purposes of a farming business,

(b) fencing, drainage or reclamation of any land for use for the purposes of a farming business, or

(c) construction, erection or installation of qualifying equipment for the purpose of micro-generation of

electricity for use solely or mainly for the purposes of a farming business being tax incurred on or after

1 January 2012,

and where such building, structure, land or qualifying equipment is for use in a farming business carried on by

me for a period of not less than one year commencing on the date the tax was incurred.

(3) I have complied with all the obligations imposed on me by the Value-Added Tax Consolidation Act 2010, the

Income Tax Acts, the Corporation Tax Acts, or the Capital Gains Tax Act and any instruments made thereunder,

in relation to the payment or remittance of the taxes, interest and penalties required to be paid or remitted

thereunder and the delivery of returns.

(4) All the particulars given on this form are true and correct to the best of my knowledge and belief.

Signature:

Date:

/

/

Status: Individual / Precedent Acting

Partner

Signature:

Date:

/

/

Status: Director / Secretary

Official Use Only

1. Warrant No.:

Customer No.:

2. Examined By:

On:

/

/

3. Checked By:

On:

/

/

4. Amount Allowed:

VAT 58 (Jan 2014)

1

RPC003933_EN_WB_L_1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4