Form Rpd-41227 - Renewable Energy Production Tax Credit Claim Form - 2012

ADVERTISEMENT

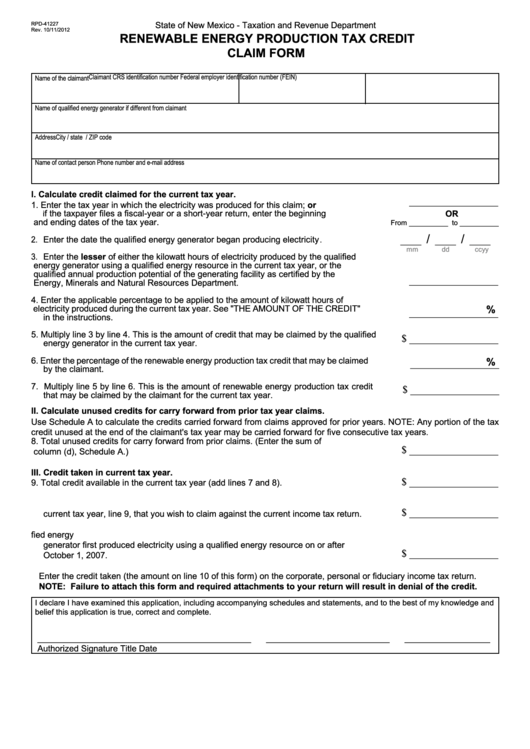

State of New Mexico - Taxation and Revenue Department

RPD-41227

Rev. 10/11/2012

RENEWABLE ENERGY PRODUCTION TAX CREDIT

CLAIM FORM

Claimant CRS identification number

Federal employer identification number (FEIN)

Name of the claimant

Name of qualified energy generator if different from claimant

Address

City / state / ZIP code

Name of contact person

Phone number and e-mail address

I. Calculate credit claimed for the current tax year.

_________________

1. Enter the tax year in which the electricity was produced for this claim; or

f the taxpayer files a fiscal-year or a short-year return, enter the beginning

OR

i

and ending dates of the tax year.

From __________ to __________

/

/

____

____

____

2. Enter the date the qualified energy generator began producing electricity.

mm

dd

ccyy

3. Enter the lesser of either the kilowatt hours of electricity produced by the qualified

energy generator using a qualified energy resource in the current tax year, or the

qualified annual production potential of the generating facility as certified by the

_________________

Energy, Minerals and Natural Resources Department.

4. Enter the applicable percentage to be applied to the amount of kilowatt hours of

electricity produced during the current tax year. See "THE AMOUNT OF THE CREDIT"

%

_________________

in the instructions.

5. Multiply line 3 by line 4. This is the amount of credit that may be claimed by the qualified

$ _________________

energy generator in the current tax year.

6. Enter the percentage of the renewable energy production tax credit that may be claimed

%

_________________

by the claimant.

7. Multiply line 5 by line 6. This is the amount of renewable energy production tax credit

$ _________________

that may be claimed by the claimant for the current tax year.

II. Calculate unused credits for carry forward from prior tax year claims.

Use Schedule A to calculate the credits carried forward from claims approved for prior years. NOTE: Any portion of the tax

credit unused at the end of the claimant's tax year may be carried forward for five consecutive tax years

.

8. Total unused credits for carry forward from prior claims. (Enter the sum of

$ _________________

column (d), Schedule A.)

III. Credit taken in current tax year.

$ _________________

9. Total credit available in the current tax year (add lines 7 and 8).

10.Credit taken in the current tax year. Enter the portion of total credit available in the

$ _________________

current tax year, line 9, that you wish to claim against the current income tax return.

11.Credit to be refunded to the claimant. Excess credit is refunded if the qualified energy

generator first produced electricity using a qualified energy resource on or after

$ _________________

October 1, 2007.

Enter the credit taken (the amount on line 10 of this form) on the corporate, personal or fiduciary income tax return.

NOTE: Failure to attach this form and required attachments to your return will result in denial of the credit.

I declare I have examined this application, including accompanying schedules and statements, and to the best of my knowledge and

belief this application is true, correct and complete.

_____________________________________________

__________________________

__________________

Authorized Signature

Title

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2